Key Points:

- Cyber insurance protects businesses against financial losses from cyberattacks, data breaches, and other digital threats.

- Coverage includes first-party costs like data restoration and third-party liabilities like legal fees.

- Policies may vary, so understanding specific inclusions and exclusions is critical for proper protection.

Cybercrime is on the rise, with the global cost of cyberattacks predicted to hit $10.5 trillion annually by 2025. For businesses, this staggering figure underscores the importance of mitigating risks tied to digital operations. Cyber insurance has emerged as a critical tool, offering financial protection in the event of breaches, ransomware, and other cyber incidents. But what does cyber insurance cover, and how can it shield your business from potential ruin?

What Does Cyber Insurance Cover?

Cyber insurance covers a wide range of risks related to digital operations and cybersecurity incidents. It provides financial protection for both first-party expenses incurred directly by your business and third-party liabilities resulting from legal claims. This includes data breaches, ransomware attacks, and more. Below, we delve deeper into the specifics of what cyber insurance policies typically include.

First-Party Coverage: Protecting Your Business’s Bottom Line

First-party coverage focuses on expenses directly incurred by your company due to a cyber incident. This is the cornerstone of most cyber insurance policies and often includes:

Data Breach Response Costs

If sensitive customer or employee data is exposed, businesses face immediate expenses to mitigate the damage. Cyber insurance can cover:

- Notification costs: Informing affected individuals about the breach.

- Credit monitoring services: Offering identity theft protection to affected parties.

- IT forensics: Investigating how the breach occurred and preventing further damage.

Business Interruption Losses

If a cyberattack disrupts your operations, the financial fallout can be significant. Coverage often includes compensation for lost income and extra expenses incurred while restoring normal operations. For instance, if ransomware shuts down your e-commerce site, cyber insurance can help cover lost revenue during downtime.

Data Restoration and Recovery

Cyberattacks like ransomware often result in corrupted or stolen data. Policies typically reimburse costs associated with recovering and restoring critical files and databases.

Third-Party Coverage: Addressing Legal and Regulatory Risks

Third-party coverage applies to claims made against your business by external parties. This is particularly important if a cyberattack impacts customers, clients, or partners.

Legal Fees and Settlements

In the event of a lawsuit following a data breach or system failure, cyber insurance can cover:

- Defense costs: Hiring legal representation.

- Settlement amounts: Paying damages awarded to affected parties.

Regulatory Fines and Penalties

Failing to comply with data protection laws like GDPR or HIPAA can result in hefty fines. Cyber insurance policies often help businesses cover these costs, though specific coverage limits may apply.

Media Liability

If your business is accused of publishing defamatory content or infringing on intellectual property rights online, cyber insurance may step in to handle associated legal fees and damages.

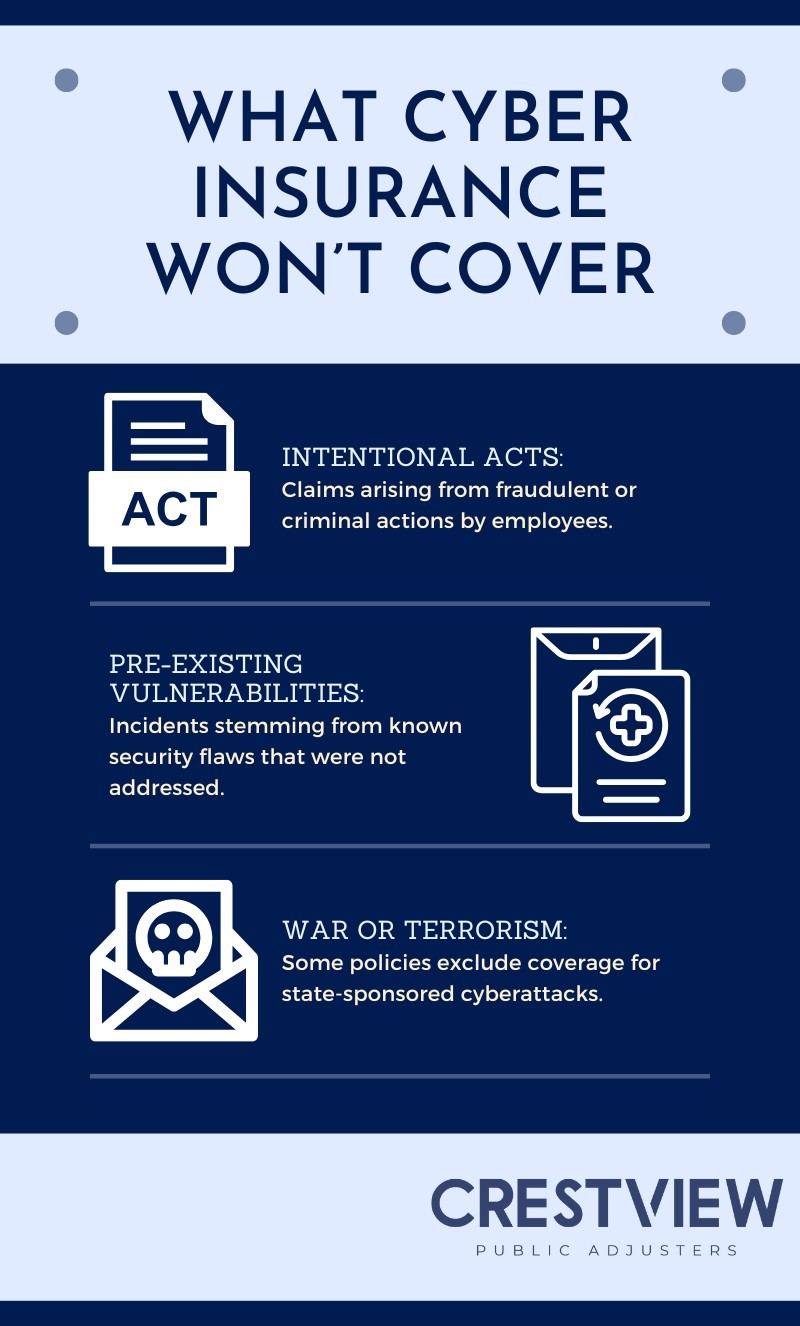

What Does Cyber Insurance Not Cover?

While cyber insurance offers broad protection, it’s equally important to understand its limitations. Common exclusions include:

Always review your policy to understand specific exclusions and negotiate terms that best fit your business needs.

How to Choose the Right Cyber Insurance Policy

Selecting the right policy involves evaluating your business’s unique risks and operational landscape. Here are a few steps to guide you:

- Assess your risk exposure: Identify key vulnerabilities in your IT infrastructure and digital operations.

- Understand policy specifics: Review coverage limits, exclusions, and deductibles to ensure they align with your needs.

- Work with experts: Consult with brokers or public adjusters specializing in cyber claims to maximize your coverage.

Why Cyber Insurance Matters for Businesses of All Sizes

No business is immune to cyber threats, regardless of size or industry. Small and medium enterprises are particularly vulnerable, as they often lack the resources to recover from an attack. Cyber insurance not only mitigates financial losses but also provides peace of mind, enabling businesses to focus on growth without the looming fear of cybercrime.

Secure Your Cyber Claims with Crestview

Cyber incidents can be overwhelming, especially when navigating insurance claims. That’s where we come in. At Crestview, public adjusters in New York specialize in helping businesses recover faster by expertly managing cyber insurance claims. From interpreting complex policies to negotiating maximum payouts, we’re here to protect your bottom line.

Don’t let a cyber incident derail your business. Contact Crestview today to get the support you need.