Key Points:

- Cyber insurance can be a valuable tool for businesses, but it’s not always the right fit for every organization.

- The scope of cyber insurance coverage varies, and it’s crucial to understand the specific risks you’re trying to protect against.

- Working with a public adjuster like Crestview can help you navigate cyber claims and maximize your recovery after a breach.

With such high stakes, businesses are increasingly turning to cyber insurance to help mitigate the financial impact of data breaches, ransomware attacks, and other cyber incidents. But is cyber insurance worth it? Let’s dive into the details to help you determine if it’s a worthwhile investment for your business.

Is Cyber Insurance Worth It?

Yes, cyber insurance is worth it for many businesses and individuals, especially given the increasing frequency of cyberattacks and data breaches. This type of insurance can help cover the costs associated with these incidents, such as legal fees, data recovery, and notification expenses. It also provides support in handling the financial aftermath of a cyberattack, which can otherwise be devastating to a company’s bottom line.

While cyber insurance may not prevent a cyberattack, it significantly mitigates the risks and provides peace of mind. With the rise of digital threats, having coverage can make a substantial difference in how well an organization or individual can recover from an attack. It is a valuable investment for those who store sensitive information or rely heavily on digital systems for their operations.

What Does Cyber Insurance Cover?

Cyber insurance isn’t a one-size-fits-all policy. The coverage can vary widely depending on the insurer and the specific policy. Generally, cyber insurance covers:

- Data breaches and privacy violations: Coverage for costs related to notifying affected individuals, offering credit monitoring services, and legal fees.

- Ransomware and cyber extortion: Pays for ransom payments and associated recovery costs.

- Business interruption: If a cyberattack disrupts your operations, cyber insurance may cover lost revenue during downtime.

- Cyber liability: This includes the legal costs and settlements associated with lawsuits stemming from a cyberattack.

While these are common elements, your policy might offer additional or different coverage based on your needs. Understanding what you’re covered for—and what you’re not—is essential to evaluate is cyber insurance worth it for your specific business.

Is Cyber Insurance Expensive?

Many business owners hesitate to invest in cyber insurance due to perceived high costs. While premiums can be expensive, the costs can pale in comparison to the potential financial loss from a cyberattack. On average, small businesses can expect to pay anywhere from $1,000 to $7,000 per year for cyber insurance, while larger organizations may face premiums in the tens of thousands.

Several factors influence the cost of cyber insurance, including:

- Business size: Larger companies often face higher premiums due to more complex cyber risk profiles.

- Industry: Certain industries, like healthcare and finance, are more likely to experience cyberattacks, leading to higher premiums.

- Coverage limits: Policies with higher coverage limits and additional riders will cost more.

To determine if the expense is justified, it’s important to assess your business’s cybersecurity risks and compare the cost of insurance against the potential cost of an attack. For some businesses, the peace of mind that comes with insurance is invaluable.

What Are the Risks of Not Having Cyber Insurance?

Going without cyber insurance can expose a business to significant risks, especially in an increasingly connected world. Without proper coverage, you may face out-of-pocket expenses that can jeopardize your company’s financial stability. Some of the most common risks include:

- Legal fees and settlements: A data breach could lead to lawsuits, and without insurance, you may be responsible for the legal costs.

- Reputation damage: If a breach occurs and customers’ sensitive information is compromised, it can lead to a loss of trust and revenue, which can be costly to recover from.

- Regulatory fines: Many industries face strict compliance regulations regarding data protection. A breach could lead to hefty fines if you’re found to be non-compliant.

The financial consequences of these risks can be devastating, especially for small to mid-sized businesses that don’t have the resources to handle a significant data breach. This is where cyber insurance becomes an essential safety net, helping to cover the costs associated with recovery and mitigation.

When Should a Business Consider Cyber Insurance?

Not every business will immediately need cyber insurance. Small businesses with minimal digital exposure may find that their risks are low enough to manage without insurance. However, as a company grows and handles more sensitive customer data or relies heavily on digital operations, the need for cyber insurance increases.

Here are some scenarios when a business should consider getting cyber insurance:

- Storing customer data: If your company handles personal information, financial records, or health data, a breach could have serious consequences.

- Dependence on digital operations: Businesses that rely on online services or e-commerce are more vulnerable to cyberattacks.

- A high-value target: If your business operates in a high-risk industry, like healthcare, finance, or legal services, you’re more likely to be targeted by cybercriminals.

- Compliance requirements: Certain industries may require you to have cyber insurance to meet regulatory standards.

Assessing these factors will help you decide if cyber insurance is worth it for your business, allowing you to make an informed decision based on your specific needs.

How to Choose the Right Cyber Insurance Policy

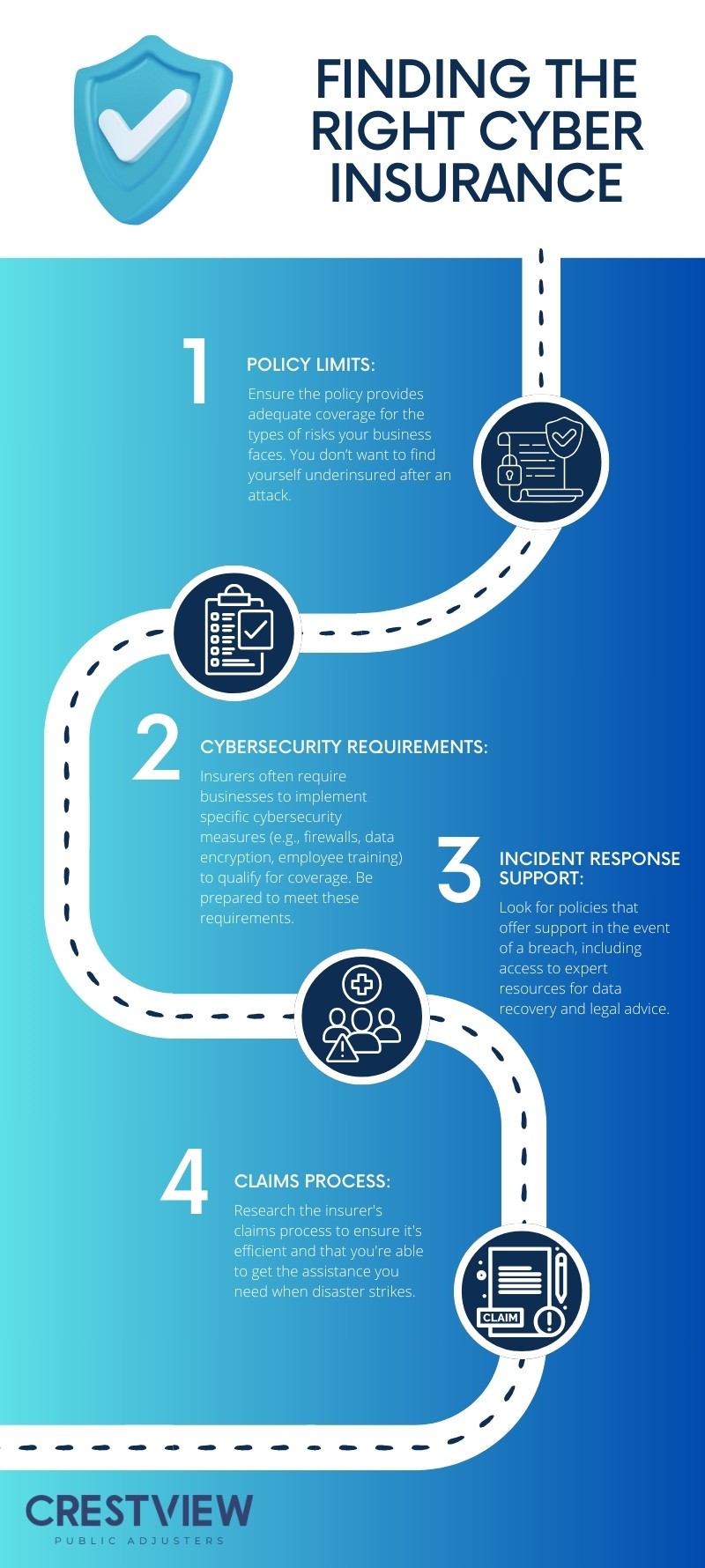

Choosing the right policy involves evaluating both your company’s needs and the available coverage options. When considering cyber insurance, keep the following in mind:

The right policy should align with your business’s risk management strategy, helping you mitigate potential losses and recover quickly from a cyberattack.

How Can Crestview Help With Cyber Claims?

If your business is already covered by cyber insurance, working with a public adjuster can help you navigate the complexities of a cyber claim. At Crestview, we specialize in representing policyholders to ensure that they get the most out of their cyber insurance policy. Our expertise in handling cyber claims allows us to:

- Maximize your settlement: We know how to handle the fine print and can advocate for you to ensure you receive the full amount you’re entitled to.

- Streamline the process: The claims process can be overwhelming, but with our help, we simplify it and guide you through every step.

- Provide expert support: We connect you with the necessary resources, including cybersecurity experts and legal professionals, to strengthen your claim.

If you’re located in New York and have experienced a cyberattack, don’t leave the future of your business to chance. Let Crestview assist you in handling your cyber insurance claim effectively.

Get the Right Help for Your Cyber Claims Today!

If you’ve been impacted by a cyberattack, don’t navigate the insurance claims process alone. Crestview, a trusted public adjuster in New York for cyber claims, can help you get the compensation you’re entitled to. Contact us today to learn how we can assist you with your cyber insurance claim and help you recover faster.