Need a Public Adjuster To File Your Claim?

Get More From Your Insurance Company Today!

Call 24/7 for a FREE Claim Assessment

Crestview Public Adjusters Has Recovered Millions of Dollars For Clients' Insurance Claims

Looking for a stress-free way to maximize your insurance claim? Look no further! Our team of experts specializes in recovering the most money possible for your covered insurance claim, leaving you free from the hassle and stress of handling it on your own. Trust us to protect your most important asset and get the compensation you deserve!

Crestview helps you get the payout you deserve FAST!

FREE CONSULTATION

Schedule a time to discuss what happened and how Crestview can help

ASSESSMENT

Assess damage and determine how much loss was incurred

STRATEGY

Collect paperwork, pictures, videos, and other proof of damage and loss to present to insurance company

TRIUMPH

Recover what you ACTUALLY deserve from your insurance company

We’ve got you covered

Fire Damage

From gas problems to electrical malfunctions, whatever the cause of your fire damage, Crestview can help manage your claim.

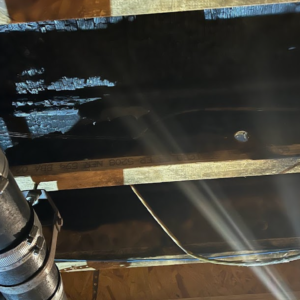

Water Damage

Crestview works with all types of water damage claims, including gray water that contains biological contaminants and black water with bacteria.

Roof Leaks

If you have a roof leak and you're preparing to make a claim with your insurance company, Crestview can help manage the process from start to finish.

Environmental

Whether you found asbestos, mold, or some other type of environmental problem, no two situations are exactly the same.

Flood Damage

Flood damage claims can be complicated. Filling out the wrong forms or describing the damage in the wrong way can leave your claim underpaid or even denied.

Storm Damage

Whether your house was struck by lightning or strong winds damaged your property, Crestview can help manage your storm damage claim.

What Clients Said about us

What Makes Crestview Special?

- Chosen by hundreds of commercial, residential, & business owners

- $10s of millions in settlements recovered

- Focused on delivering your expected outcomes

- Innovative, tested systems to maximize results

Our Services

We make sure you have the documentation and resources you need during a time of need to get results quickly and efficiently.

It is important to make sure that you have everything you need to file your damage claim properly and quickly.

Public adjusters can help you deal with the frustrations of filing a covered insurance claim with your insurance company.

Our job as public adjusters is to make sure your business isn’t at risk of loss during an unexpected interruption.

WHO WE ARE & Our Advantage

With over 50 years of combined real estate experience, Crestview Public Adjusters have established roots. We understand what it takes to protect your asset while maximizing your insurance claim. Coupled with substantial institutional experience, our team brings a sophisticated approach to any type of claim. We have negotiated millions of dollars in recovery on behalf of commercial and residential policyholders. We approach every claim in a position of advocacy working exclusively on behalf of the policyholder, not the insurance company. We handle all the details that are involved in submitting your covered insurance claim, down to the final settlement with your insurance company.

Claim Types We Can Help With

- Fire

- Flood

- Hail

- Hurricane

- Tornado Windstorm

- Water

- Frozen Pipes

- Business Interruption

- Inland Marine

- Ice Dams

- Mold

- Snow

- Equipment Breakdown

- Collapse

- Builders Risk

- Electrical Breakdown

- Explosion

Industries We Work With

- Commercial

- Industrial

- Multifamily

- Office buildings

- HOA (Homeowners association)

- Co-ops

- Residential

- Business owners

- Homeowners

- Institutions

- Non profit Institutions