Key Points:

- Smoke damage in insurance refers to physical harm caused by smoke particles infiltrating property during a fire or similar events.

- Coverage typically depends on the policy type and the event that caused the damage.

- Understanding the types of smoke damage is critical for filing accurate claims.

Fires cause billions of dollars in damage annually, with smoke being one of the most overlooked aspects of property destruction. Smoke doesn’t just leave behind odor—it can lead to structural and health issues that persist long after a fire. Understanding what is considered smoke damage in insurance policies ensures you’re properly covered and prepared to file claims. This article will break down the types of smoke damage, what insurance covers, and why public adjusters can help.

What Is Considered Smoke Damage?

Smoke damage refers to the physical and chemical impact of smoke particles on property, including discoloration, odors, and structural deterioration. This type of damage occurs when smoke particles from fire, electrical malfunctions, or other sources infiltrate surfaces like walls, ceilings, furniture, and ventilation systems.

Smoke damage isn’t always immediately visible. It can seep into porous materials like wood and fabric, leading to long-term degradation. Additionally, acidic residues from smoke may corrode metals and other materials over time. For these reasons, insurance adjusters typically evaluate smoke damage as part of fire damage claims.

Types of Smoke Damage in Insurance

Smoke damage isn’t uniform; it varies depending on the type of fire and materials involved. Below are the most common types:

1. Wet Smoke Damage

Wet smoke results from low-temperature, smoldering fires involving items like rubber or plastic. This type of smoke leaves behind sticky residues that are difficult to clean.

- Characteristics: Thick, smeary residue with a strong, unpleasant odor.

- Common Challenges: Requires specialized cleaning and often leads to discoloration of surfaces.

2. Dry Smoke Damage

Dry smoke is produced by high-temperature fires that burn wood or paper. It is lighter and powdery, but it can easily penetrate cracks and porous materials.

- Characteristics: Fine soot particles that settle into hard-to-reach areas.

- Common Challenges: Cleaning requires professional-grade equipment to avoid pushing soot deeper into surfaces.

3. Protein Smoke Damage

This type of damage is caused by burning organic materials, like food or grease, often in kitchen fires.

- Characteristics: Invisible residues that cause discoloration and strong odors.

- Common Challenges: Protein smoke damage is notoriously hard to detect but can result in long-lasting smells.

4. Fuel-Oil Smoke Damage

Often resulting from furnace malfunctions, fuel-oil smoke leaves greasy, sticky residues behind.

- Characteristics: Oily soot that clings to surfaces and stains fabric and walls.

- Common Challenges: Cleaning requires solvents and professional remediation.

Does Insurance Cover Smoke Damage?

Most homeowner’s and renter’s insurance policies cover smoke damage, but the specifics depend on your policy.

Situations Typically Covered:

- Accidental Fires: Damage from fires caused by electrical malfunctions or accidents.

- Neighboring Property Fires: Smoke damage from a fire on a nearby property.

- Wildfires: Policies in wildfire-prone areas may include smoke coverage.

Situations Not Covered:

- Intentional Fires: Damage caused by arson or deliberate actions may not be covered.

- Lack of Maintenance: Smoke damage from neglected appliances or systems might be excluded.

Understanding your policy’s exclusions and inclusions is essential. If you’re unsure about coverage, a public adjuster can assist in clarifying and maximizing your claim.

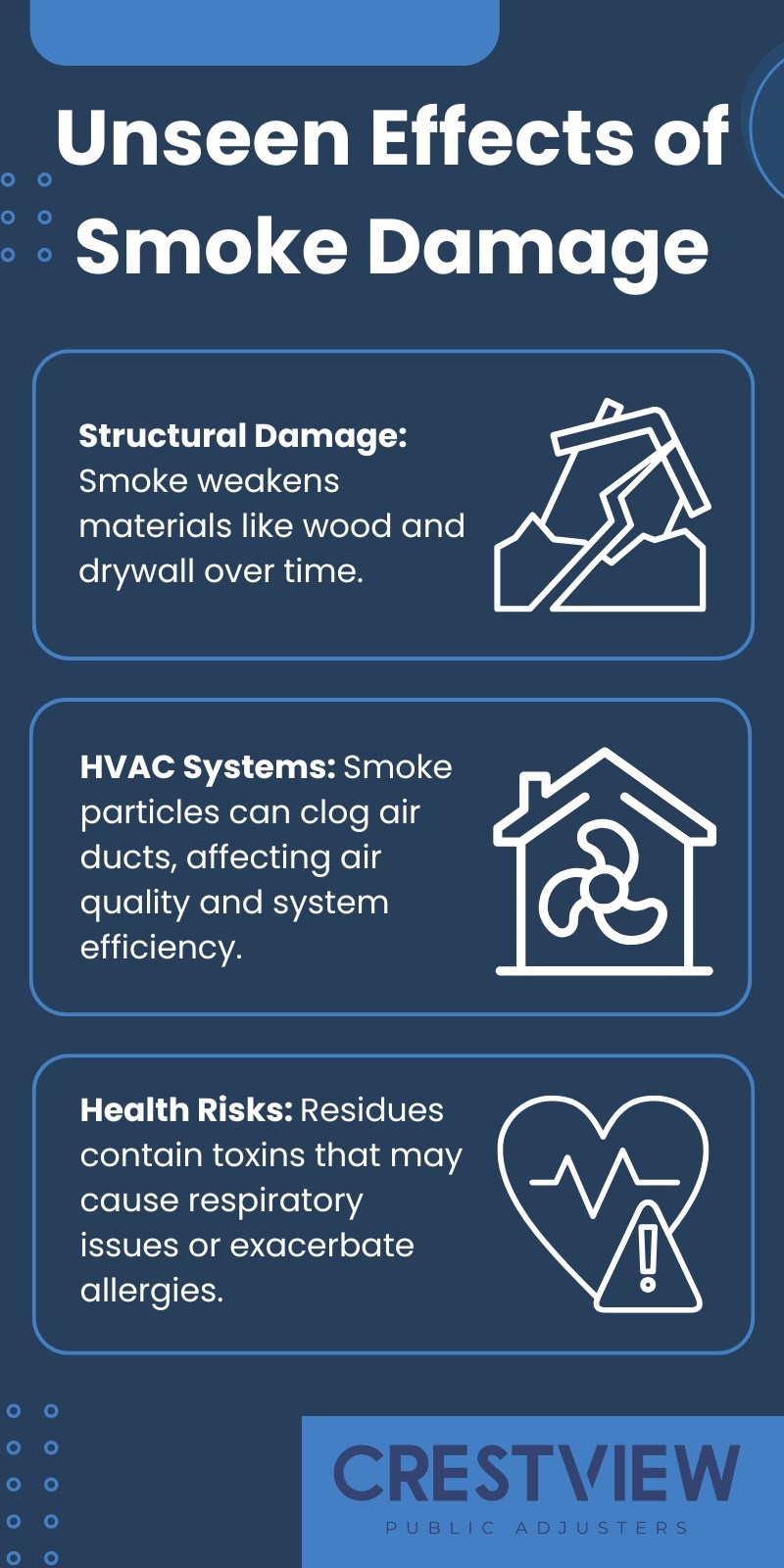

The Hidden Impact of Smoke Damage

Smoke damage extends beyond the visible. Below are areas commonly affected:

These hidden effects highlight the importance of addressing smoke damage quickly and thoroughly to avoid long-term issues.

Filing a Smoke Damage Insurance Claim

To ensure your claim is successful, follow these steps:

- Document the Damage: Take photos and videos of all affected areas, including hidden spots like vents or behind furniture.

- Notify Your Insurance Company Immediately: Inform your insurer as soon as possible to avoid claim delays.

- Hire a Public Adjuster: Public adjusters can help assess the damage, negotiate with the insurer, and ensure you receive the compensation you deserve.

Why Public Adjusters Are Critical for Smoke Damage Claims

Navigating smoke damage claims can be complex, especially when insurers deny or undervalue claims. Public adjusters act as your advocate, ensuring all damages are accounted for and fairly compensated. They specialize in identifying hidden smoke damage and documenting it to strengthen your case.

Let Us Help You Maximize Your Smoke Damage Claim

If you’re dealing with smoke damage in Florida, New York, or New Jersey. Crestview is here to guide you through the claims process. Our experienced public adjusters specialize in fire and smoke damage claims, ensuring you receive the full compensation you’re entitled to. Contact us today to get started!