Key Points:

- Understanding your insurance policy’s coverage is crucial before filing a winter storm damage claim.

- Proper documentation, including photos and receipts, strengthens your case for fair compensation.

- Working with a public adjuster can help maximize your claim and ensure a smoother process.

Filing an insurance claim after a winter storm can be challenging, but documenting the damage, reviewing your policy, and filing promptly are key steps to securing fair compensation. Insurers often have strict timelines and specific requirements, so gathering detailed evidence and following the correct procedure is crucial. Below, we’ll walk you through everything you need to know to ensure a successful claim.

Understanding Your Policy: What Does Winter Storm Insurance Cover?

Insurance coverage for winter storm damage varies by policy, but most standard homeowners’ insurance plans cover:

- Roof and Structural Damage: If heavy snow or ice causes your roof to collapse, your insurance should cover repairs.

- Burst Pipes: Sudden freezing temperatures can lead to pipe bursts, often covered under water damage protection.

- Wind and Ice Damage: High winds can damage siding, windows, and roofs, while ice accumulation may lead to hazardous conditions.

However, flooding from melted snow is typically not covered under standard homeowners’ insurance. If you live in an area prone to winter flooding, a separate flood insurance policy may be necessary.

Before filing a claim, review your policy details, including deductibles and exclusions, to avoid surprises. If you’re unsure about your coverage, consulting with a public adjuster can help clarify what you’re entitled to receive.

Step-by-Step Guide to Filing an Insurance Claim After a Winter Storm

1. Assess and Document the Damage

Once it’s safe, thoroughly inspect your property and take high-quality photos of all affected areas. Be sure to:

- Capture before-and-after comparisons if possible.

- Record videos showing the extent of the damage.

- Keep receipts for temporary repairs or additional expenses like hotel stays if your home is unlivable.

2. Prevent Further Damage

Insurance companies require policyholders to take reasonable steps to prevent worsening damage. This means:

- Tarping broken windows or holes in the roof.

- Shutting off water to avoid additional pipe bursts.

- Removing heavy snow buildup from structures if safe to do so.

Failing to take these steps could lead to claim denials.

3. Notify Your Insurance Provider Promptly

Most insurers have strict deadlines for filing claims after a winter storm. Call your insurance company as soon as possible to:

- Report the damage and get a claim number.

- Confirm your coverage details and deductible.

- Request an adjuster inspection for an official damage assessment.

4. Keep a Detailed Record of All Interactions

Maintain a log of every conversation with your insurance company, including:

- Names of representatives you speak with.

- Dates and times of discussions.

- Any promises or statements made regarding your claim.

This documentation can help prevent disputes later.

5. Consider Hiring a Public Adjuster

Insurance companies send their own adjusters, who work in their best interest—not yours. A public adjuster represents you, ensuring:

- A thorough evaluation of your damages.

- You receive the maximum payout under your policy.

- Faster resolution by handling negotiations on your behalf.

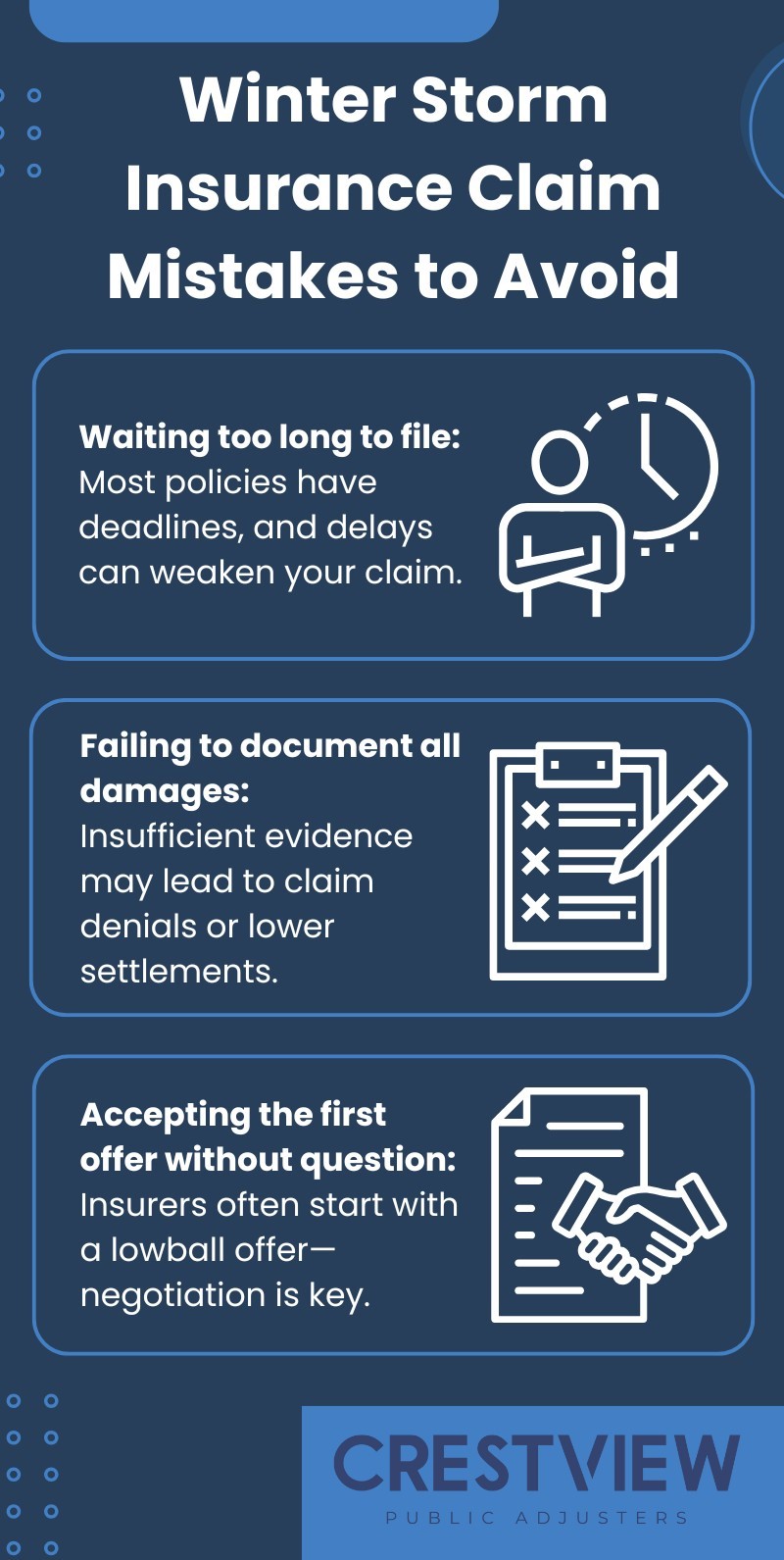

Common Mistakes to Avoid When Filing a Winter Storm Insurance Claim

Even a small mistake can delay or reduce your payout. Avoid these pitfalls:

Why Winter Storm Claims Get Denied—and How to Fight Back

Insurance companies may deny claims for reasons like:

- Pre-existing damage unrelated to the storm.

- Failure to mitigate further damage after the storm.

- Policy exclusions that limit coverage.

If your claim is denied unfairly, you can appeal by:

- Reviewing your policy and requesting a detailed explanation for the denial.

- Providing additional evidence, such as repair estimates from independent contractors.

- Hiring a public adjuster to negotiate on your behalf.

Maximize Your Winter Storm Insurance Claim with a Public Adjuster

Navigating insurance claims after winter storms can be stressful, especially when insurers push back on rightful payouts. At Crestview, we specialize in helping homeowners in New Jersey, New York, and Florida fight for the compensation they deserve.

Don’t settle for less than what you’re owed. Contact Crestview today and let us fight for you.