Key Points:

- Filing a fire damage insurance claim requires prompt documentation, assessment, and communication with your insurer.

- Insurance companies often undervalue claims, so understanding your policy and working with a public adjuster can maximize your settlement.

- Crestview Public Adjusters helps policyholders in New Jersey, New York, and Florida navigate fire damage claims efficiently.

With homeowners often struggling to get fair insurance payouts. Insurers may delay, deny, or undervalue claims, leaving policyholders in financial distress. If your home or business suffers fire damage, filing a proper claim is critical to securing the compensation you deserve.

How to File an Insurance Claim for Fire Damage

Filing a fire damage claim involves multiple steps, from reporting the incident to negotiating your payout. To file an insurance claim for fire damage, immediately notify your insurer, document all losses, and review your policy to understand coverage limits. Working with a public adjuster can improve your chances of receiving a fair settlement.

What to Do Immediately After a Fire

After ensuring safety, your next steps are crucial in strengthening your fire damage claim.

- Contact the Fire Department – Obtain an official fire report, as insurers often require this documentation.

- Secure the Property – Prevent further damage by boarding up windows and covering exposed areas.

- Document Everything – Take photos and videos of the damage before making any repairs.

These actions create a strong foundation for your claim and reduce the risk of your insurer denying compensation due to neglect.

Understanding Your Fire Insurance Coverage

Before filing a claim, you need to understand what your homeowners’ or business insurance covers. Policies vary, but they typically include:

- Dwelling Coverage – Repairs or rebuilds the structure of your home.

- Personal Property Coverage – Pays for damaged belongings like furniture and electronics.

- Loss of Use Coverage – Covers temporary housing if your home is uninhabitable.

- Liability Protection – Covers damages if the fire affects a neighbor’s property.

Some policies exclude smoke damage, additional living expenses, or replacement costs. Reviewing your policy ensures you know what to expect.

How to Document Fire Damage for Your Claim

Proper documentation is key to proving the extent of your loss. Follow these steps:

- Take High-Quality Photos and Videos – Capture every affected area, including walls, ceilings, and belongings.

- List All Damaged Items – Include brand, model, and estimated value for personal property.

- Gather Purchase Receipts – Proof of ownership strengthens your claim.

- Obtain Fire Department Reports – These confirm the cause and extent of the fire.

Providing detailed evidence prevents insurers from undervaluing your claim.

Notifying Your Insurance Company

Once you’ve documented the damage, notify your insurance provider. Be prepared to:

- Provide Basic Details – Include the date, cause (if known), and extent of the fire.

- Submit Initial Documentation – Send photos, videos, and your inventory list.

- Request a Claims Adjuster Inspection – Your insurer will assign an adjuster to assess the damage.

Be cautious with what you say—insurers may use vague statements against you to minimize payouts.

The Insurance Adjuster Inspection: What to Expect

An insurance adjuster will inspect the fire damage to determine how much they’ll pay. However, their goal is to protect the insurance company’s interests, not yours.

During the inspection:

- Be Present – Walk through the property with the adjuster to ensure they assess all damages.

- Take Notes – Record everything the adjuster says about coverage and estimates.

- Request a Written Estimate – Compare their valuation with your own records.

If the insurer’s estimate is too low, consider hiring a public adjuster to negotiate on your behalf.

How to Maximize Your Fire Damage Claim

Insurance companies often offer settlements lower than the actual cost of repairs. To increase your payout:

- Get Independent Repair Estimates – Contractors can provide fair repair cost assessments.

- Don’t Rush to Accept the First Offer – Initial offers are often lowball figures.

- Hire a Public Adjuster – They advocate for you, ensuring you get the compensation you deserve.

Many policyholders settle for less because they don’t realize they can negotiate.

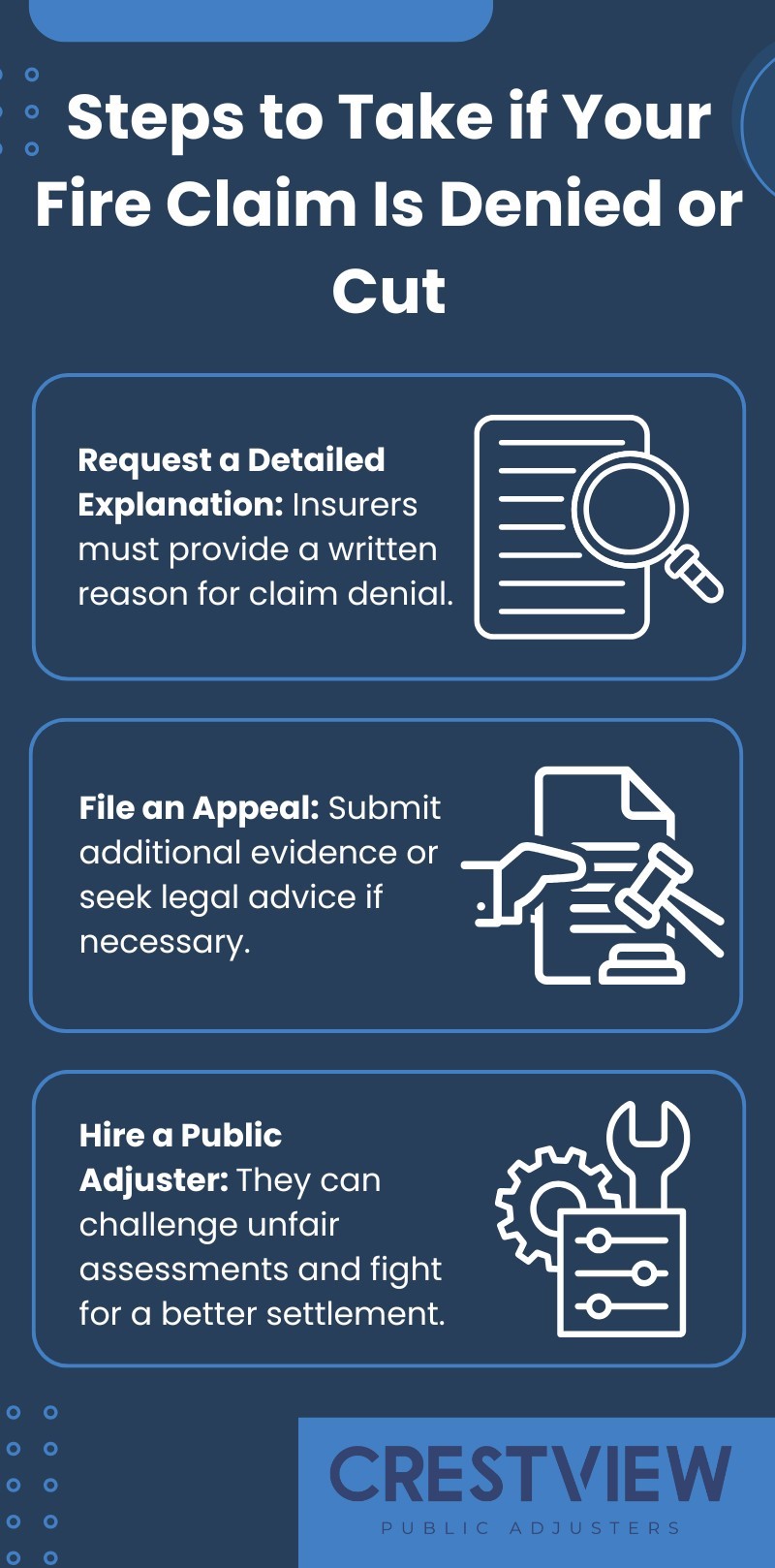

What If Your Fire Damage Claim Is Denied or Undervalued?

If your insurer denies or underpays your claim, don’t panic. You can:

Public adjusters are experts in insurance claims and can make a significant difference in the outcome.

Get the Compensation You Deserve for Fire Damage

Navigating a fire damage claim alone can be overwhelming, especially when insurance companies push back. At Crestview Public Adjusters, we specialize in securing fair settlements for fire damage claims in New Jersey, New York, and Florida. Our team fights for policyholders, ensuring you receive every dollar you’re entitled to.

If your fire insurance claim has been delayed, undervalued, or denied, let Crestview Public Adjusters handle the process for you. Contact us today to maximize your compensation!