Key Points:

- Understanding the difference between a public adjuster and an attorney for business interruption claims.

- The role of public adjusters in maximizing insurance claim payouts.

- When to hire an attorney or a public adjuster for a business interruption claim.

- Benefits of working with experts in New Jersey, New York, and Florida.

The world of business insurance can be confusing, especially when you are facing the aftermath of an event that causes significant disruption to your business operations. The impact is often devastating, but the right assistance can make all the difference in recovering losses.

A business facing interruption relies on two key professionals: public adjusters and attorneys. Both have their roles in handling claims, but many business owners are often left wondering: public adjuster vs attorney for business interruption claims—who should you hire?

In this article, we’ll break down the functions of both, the benefits they bring, and when it’s best to bring in each. By the end, you’ll have a clear understanding of which professional is best suited to help you recover your losses.

What Is the Difference Between a Public Adjuster and an Attorney for Business Interruption Claims?

The roles of a public adjuster and an attorney might seem similar at first glance, but they are distinct and tailored for specific aspects of the claims process.

A public adjuster is a professional who works directly for the policyholder, reviewing the extent of the damage, analyzing the claim, and working with the insurance company to secure the highest possible payout based on the policy’s terms. Their job is to represent you, the policyholder, in all dealings with your insurance company, ensuring that you’re compensated fairly for the interruption to your business.

On the other hand, an attorney specializing in business interruption claims generally comes into play if there are legal disputes involved, such as a denial of claim, policy interpretation issues, or if a lawsuit is required against the insurer. They provide legal guidance and represent you in court, dealing with legal complexities that go beyond the negotiation phase.

So, when it comes to business interruption claims, public adjuster vs attorney comes down to whether you need help negotiating with your insurance company (public adjuster) or handling a legal dispute (attorney).

Why Choose a Public Adjuster for Business Interruption Claims?

If your business is facing an interruption claim, a public adjuster can be a huge asset. Here’s why:

- Expertise in Claim Maximization: Public adjusters are skilled in assessing all aspects of your business, from inventory loss to income loss. They know how to maximize claims for business interruption, ensuring that you receive all the compensation you’re entitled to.

- Knowledge of Insurance Policies: Public adjusters have deep knowledge of insurance policies and how they work. They can help you navigate complex insurance jargon and ensure that every aspect of your loss is covered, even the ones that might seem insignificant but are critical for your claim.

- No Out-of-Pocket Fees: Public adjusters work on a contingency fee basis, meaning they don’t charge you upfront. Instead, they take a percentage of the claim payout. This means there’s no risk involved on your part, and you only pay if you win.

While an attorney may become necessary for complex legal issues, a public adjuster for business interruption claims is usually the first person you should call. They are experts at getting you the compensation you need to get your business back on track.

Why Choose an Attorney for Business Interruption Claims?

While public adjusters are excellent at negotiating with insurance companies, attorneys come into play when things get legally complicated. Here’s when you might need an attorney:

- Denial of Claim or Bad Faith Practices: If your insurance company denies your claim or fails to act in good faith, an attorney is needed to pursue legal action against the insurer. A lawyer will understand your legal rights and options and can help you take the insurer to court if necessary.

- Complex Policy Disputes: Some business interruption claims may involve disputes over policy language or whether specific losses are covered under your insurance. Attorneys are equipped to handle these complexities and interpret legal terms that could affect your claim’s outcome.

- Lawsuits and Litigation: If your case involves a lawsuit—whether for breach of contract, fraud, or other legal matters—you’ll need an attorney. They can help you with the litigation process, ensuring that your rights are protected throughout the legal proceedings.

If your case is straightforward, an attorney might not be necessary. However, for legal disputes that require litigation, an attorney for business interruption claims is essential for protecting your interests.

When Should You Hire a Public Adjuster vs Attorney?

Knowing when to hire a public adjuster or an attorney can be challenging, but understanding the role of each professional can help you make the right decision. A public adjuster is ideal when your business interruption claim is clear-cut with no dispute from the insurance company, when you want someone with extensive knowledge of insurance policies to handle negotiations, or when you’re looking to maximize your payout without entering into legal disputes.

On the other hand, an attorney should be hired if the insurance company denies your claim, if you suspect bad faith practices, if there’s confusion about policy language or coverage limits requiring legal interpretation, or if your claim involves complex legal issues or requires a lawsuit. For many business owners, the best approach is to hire a public adjuster first, as they specialize in negotiating favorable outcomes without legal action. If complications arise, you can then involve an attorney to manage the legal aspects of the dispute.

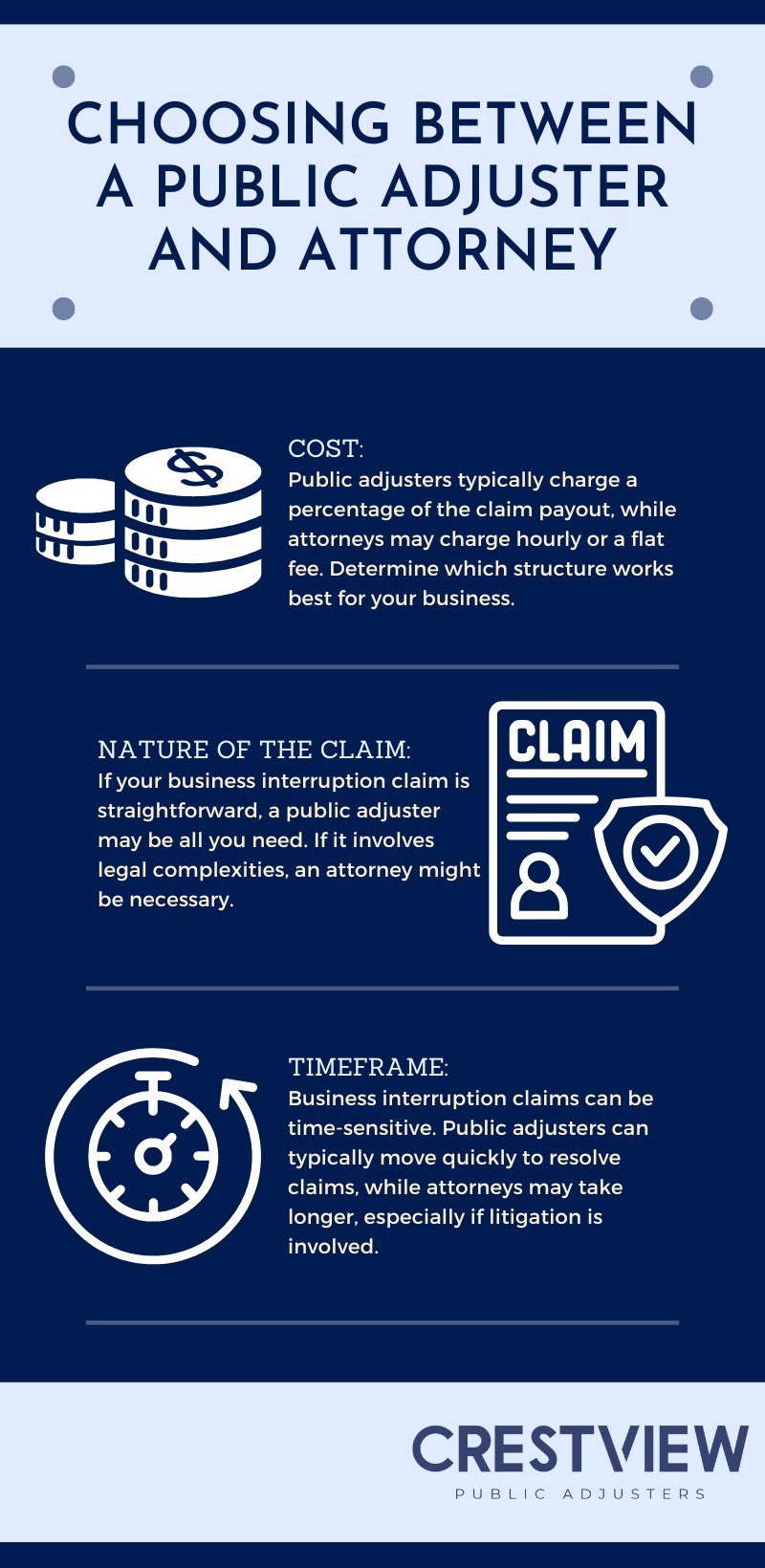

Key Considerations in Choosing Between a Public Adjuster and an Attorney

Before making a decision, consider these points:

Get Expert Help with Your Business Interruption Claim

Navigating a business interruption claim can be overwhelming, but you don’t have to go it alone. Whether you need the expertise of a public adjuster vs attorney for business interruption claims depends on the complexity of your situation. For straightforward claims, a public adjuster is your best bet, but for complex legal disputes, an attorney will be necessary.

Contact Crestview Public Adjusters Today

If you’re dealing with a business interruption claim in New Jersey, New York, or Florida, Crestview Public Adjusters is here to help. Our team of experts can guide you through the claims process and fight for the compensation you deserve. We specialize in cyber insurance claims and will ensure your business is back on its feet quickly. Reach out today for professional assistance from a public adjuster for business interruption claims.