Key Points:

- The average insurance payout for water damage varies between $5,000 and $15,000, depending on the severity and cause of the damage.

- Factors like policy coverage, water source, and claim process significantly affect the payout amount.

- Hiring a public adjuster can maximize your claim and ensure a fair settlement.

The average insurance payout for water damage typically ranges from $5,000 to $15,000, but this varies depending on the extent of the damage, the cause, and the specifics of the homeowner’s insurance policy. Minor leaks or localized damage might receive lower payouts, while extensive flooding or burst pipes could lead to higher claims, sometimes exceeding $25,000. However, with the right public adjuster and strategic approach, homeowners can maximize their claims and ensure they receive the full compensation they deserve.

How Much Does Insurance Pay for Different Types of Water Damage?

Water damage claims aren’t all the same. Insurance companies classify water damage based on its source and severity, which directly impacts the payout. Understanding these classifications can help homeowners set realistic expectations.

1. Sudden & Accidental Water Damage

If a pipe bursts, an appliance malfunctions, or a water heater leaks, insurance typically covers the damage. However, policies vary in how they handle hidden leaks versus immediate failures.

- Payout Range: $5,000 – $15,000

- Common causes: Burst pipes, plumbing failures, HVAC leaks

- Factors affecting payout: Location of the damage, property value, and repair costs

2. Flood Damage (Not Typically Covered)

Flooding from natural disasters like hurricanes or overflowing rivers is not covered under standard homeowners’ insurance. Instead, flood insurance policies (through FEMA or private insurers) are required.

- Payout Range: Varies widely but often $20,000 – $50,000+

- Common causes: Storm surges, heavy rainfall, river overflows

- Factors affecting payout: Elevation of home, type of flood coverage, and total loss assessment

3. Sewer Backup & Overflow

Water damage from backed-up sewers or overflowing drains is only covered if the homeowner has a sewer backup rider added to their policy. Many standard policies exclude this.

- Payout Range: $3,000 – $10,000

- Common causes: Clogged sewer lines, tree root intrusion, municipal system failures

- Factors affecting payout: Policy endorsements, extent of contamination, and damage severity

4. Slow Leaks & Negligence (Often Denied Claims)

Damage that occurs gradually—such as a small pipe leak that goes unnoticed for months—is often denied by insurance companies due to lack of maintenance.

- Payout Range: Often $0 unless proven as a sudden event

- Common causes: Leaky faucets, roof leaks, gradual plumbing failures

- Factors affecting payout: Proof of maintenance, when the damage was discovered, and if mold is present

The Importance of Working with Expert Public Adjusters

The numbers above are just averages—but with the right public adjuster and strategic approach, your claim can be worth far more. At Crestview Public Adjusters, we don’t just file claims; we build strong cases with expert documentation, policy analysis, and aggressive negotiations to maximize settlements.

Here are some of the strategies we’ve used in real case studies to secure bigger, better payouts for our clients:

🔹 Brooklyn Basement Disaster – Building a Stronger Case: A sewage backup and mold infestation led to a lowball $30,000 offer. We leveraged expert assessments, detailed contamination reports, and policy loopholes to increase the payout to $115,000—nearly four times the original amount.

🔹 Jewish Community Center Flooding – Overcoming Insurance Resistance: A broken urinal caused extensive water damage across 20,000 square feet. The insurer attempted to downplay the scope, but our team’s aggressive negotiations, structural damage assessments, and loss of use calculations led to a $2.2 million settlement.

🔹 Long Branch Condo Overflow – Proving the Full Impact: A routine bathroom flood? Not quite. By demonstrating hidden contamination risks and the true cost of repairs, we pushed past the insurer’s low estimate and secured a $175,000 payout—ensuring the homeowner didn’t pay out of pocket.

These real-life case studies prove that having the right public adjuster on your side makes all the difference. If your property has suffered damage, don’t settle for less. Let Crestview Public Adjusters handle the strategy and fight for the settlement you deserve. Call (551) 316-7204 for a FREE claim assessment!

What Factors Affect Your Water Damage Insurance Payout?

Every insurance claim is different, but a few critical factors determine how much a homeowner will receive in compensation.

1. Policy Limits & Deductibles

Insurance policies come with coverage limits and deductibles that directly impact payouts.

- If your policy covers up to $50,000 for water damage but the repairs only cost $10,000, you’ll receive $10,000.

- If you have a $1,000 deductible, that amount is subtracted from your claim payout.

2. Cause of Water Damage

Insurers distinguish between sudden damage (covered) and gradual damage (often denied). Claims with clear, documented causes receive faster and higher settlements.

3. Type of Home & Materials

- Older homes with outdated plumbing systems may receive lower payouts due to depreciation.

- High-value materials (hardwood floors, marble countertops) may qualify for higher settlements.

4. How the Claim is Filed

Homeowners who properly document their damage, provide evidence, and work with a public adjuster often receive higher settlements than those who handle the claim alone.

How to Maximize Your Water Damage Insurance Claim

1. Document Everything Immediately

The more proof you provide, the stronger your claim. Immediately after discovering damage, take the following steps:

- Photograph and video all affected areas, including walls, floors, and belongings.

- Write down dates, times, and the cause of the damage.

- Keep receipts for repairs, hotel stays, and damaged items.

2. Prevent Further Damage

Insurance companies expect homeowners to take action to prevent the situation from worsening.

- Shut off water supply if needed.

- Use fans or dehumidifiers to reduce moisture buildup.

- Save receipts for any temporary repairs (these are often reimbursed).

3. Work With a Public Adjuster

Insurance companies are for-profit businesses, meaning they might undervalue claims. Public adjusters advocate for you, ensuring you get the maximum payout possible.

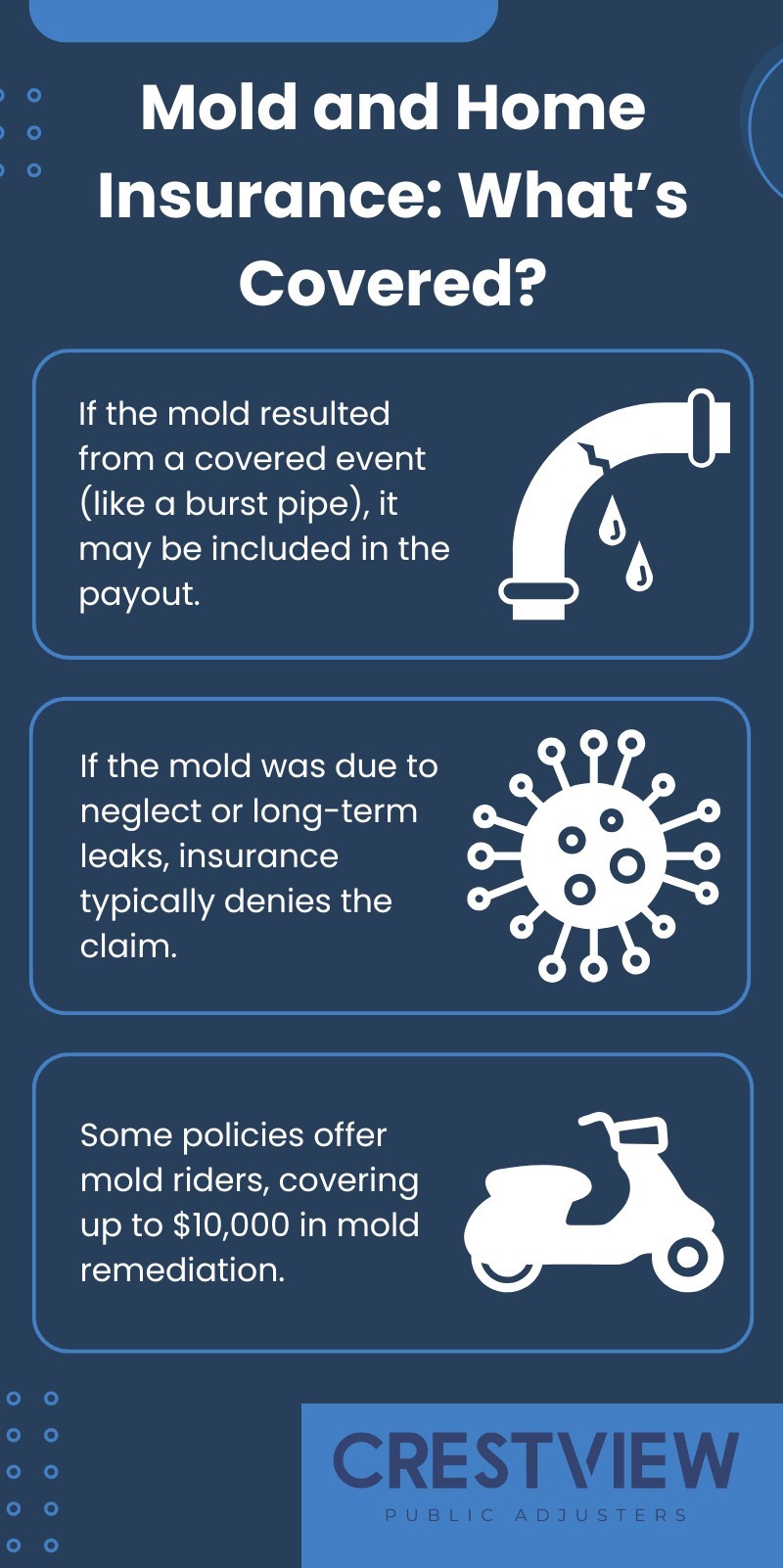

Does Homeowners Insurance Cover Mold After Water Damage?

Mold is a common consequence of water damage, but insurance coverage varies:

How Long Does It Take to Get a Payout for Water Damage?

Insurance companies aim to settle claims within 30 to 60 days, but this varies:

- Small claims ($5,000 or less) → Often processed within a few weeks.

- Moderate claims ($10,000 – $20,000) → Takes one to two months.

- Large claims ($50,000+) → Can take several months if disputes arise.

Hire a Public Adjuster for Your Water Damage Claim

Filing a water damage claim can be stressful, time-consuming, and frustrating—especially when insurers try to lowball your payout. Crestview Public Adjusters helps homeowners fight for the compensation they deserve.

With expertise in water damage claims in New Jersey, New York, and Florida, our adjusters ensure you receive the maximum possible payout. Whether your damage was caused by a burst pipe, sewer backup, or flooding, we handle the claim process so you don’t have to.

Don’t settle for less than you deserve. Contact Crestview Public Adjusters today for a free consultation!