The Crestview Blog

Learn more about public adjusting and how it can help with your insurance claim

Public Adjuster for Fire-Related Business Interruption Claims

Key Points: Fires can be devastating to businesses. For many business owners, these fires cause not only property damage but also a loss of income,

Planning for the Next Crisis: Public Adjuster Tips for Better Business Interruption Coverage

Key Points: Public adjuster tips for better business interruption coverage include understanding what events your policy actually covers, verifying your coverage limits against your current

Public Adjuster Help After a Natural Disaster Shuts Down Your Business

Key Points: Public adjuster help after a natural disaster involves licensed professionals working on your behalf—not the insurance company’s—to assess damage, interpret your policy, and

Public Adjuster vs. Non-Public Adjuster: Understanding the Difference and Making an Informed Choice

When faced with an insurance claim, property owners often find themselves navigating a complex and overwhelming process. In such situations, hiring an adjuster can provide much-needed assistance. But what are the differences between a public adjuster and a non-public adjuster?

Understanding Cyber Claims Statistics: Protecting Your Business in the Digital Age

In today’s digital age, businesses face an increasing risk of cyber threats and attacks. Understanding the latest cyber claims statistics is essential for businesses to protect themselves from potential financial losses and reputational damage.

Understanding Homeowners Insurance Claims: Protecting Your Property and Finances

Homeowners’ insurance is essential for safeguarding your home and finances against a wide range of risks. From natural disasters to damage caused by human error, homeowners’ insurance protects you financially when unexpected events occur.

Understanding Cyber Claims Statistics: The Importance of Cyber Insurance

In today’s interconnected world, cyber threats continue to evolve, posing significant risks to businesses of all sizes. As the frequency and complexity of cyber-attacks increase, organizations must protect themselves with robust cybersecurity measures and comprehensive cyber insurance coverage.

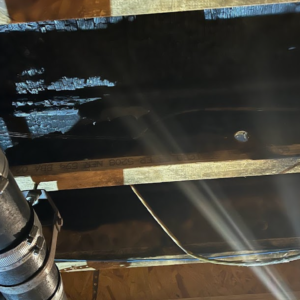

Case Study: Frozen Pipe in North Bergen, NJ

A newly constructed property experienced a burst in a sprinkler elbow pipe, which had frozen. The water damage affected a total of 14 units, including all units located below the affected area and even extended to the neighboring building. The extent of the water damage was substantial, prompting our hiring on the same day as the incident.

Case Study: Fire and Lightning Strike Old Westbury

A lightning strike impacted a gas vent located on the roof of a 10,000-square-foot residence. The electrical discharge traveled down the vent pipe, leading to a fire outbreak in the basement. Consequently, the basement fire resulted in smoke damage that spread throughout the entire house. Crestview reached a settlement of $850,000 for the claim within a remarkably brief period of fewer than 90 days.

Case Study: Investment Property Fire NYC Upper West Side

A blaze ignited from an electric scooter within a first-floor apartment, resulting in harm to the building’s exterior and all ten residential units. Crestview’s successfully filed a comprehensive claim, securing the full reimbursement for both property damages and business interruption losses. The total loss amounted to $1.8 million.

5 Essential Tips to Safeguard Yourself Against Cyber Crimes

Follow these essential tips to safeguard your online presence, reduce the risk of cyber attacks, and maximize recovery with Crestview Public Adjusters.

What You Need To Know About Burst Pipes

Winter weather can seriously damage pipes, causing leaks and bursts that can lead to costly repairs and extensive water damage. Thankfully, there are several steps you can take to prevent frozen pipes and mitigate damage and losses in case of a burst.

Does Homeowner’s Insurance Cover Frozen Pipes?

The importance of proper maintenance and preventative measures to protect pipes from freezing. Also, coverage for secondary water damage, personal property damage, and loss of use, along with the guidelines for insulating pipes, setting thermostats appropriately, and winterizing homes.

Cyber Liability Insurance Complete Guide

The basics of cyber liability insurance, including the common cyber attack occurrences covered such as data breaches, malware attacks, phishing attacks, and ransomware. The different types of security provided by cyber liability insurance, such as network security, privacy liability, network business interruption, media liability, and errors and omissions coverage.

Cyber Security Insurance Claim Basics

As the world increasingly moves online, the risk of cyber attacks grows. Businesses of all sizes need to be prepared for the possibility of a data breach, and one way to do this is to purchase cyber security insurance.

RECENT RESULTS: Roof Damage in Teaneck, NJ

After a tree fell on the roof of a New Jersey residence, the roof was severely damaged and was in need of repair. Josh Berkowitz at Crestview Public Adjusters was able to retrieve $80,000 to help the homeowner pay for the roof repair.