Key Points:

- Insurance may cover water damage in basements, but it depends on the cause and your policy type.

- Standard homeowners insurance usually covers sudden and accidental water damage but not flooding or gradual leaks.

- Filing a claim and proving the damage cause correctly can make a difference in approval.

Most standard homeowners insurance policies cover sudden and accidental water damage, such as a burst pipe or an appliance failure. However, flooding from external sources is typically excluded and requires separate flood insurance. Gradual damage, poor maintenance, and foundation seepage are also usually not covered. Always review your policy to understand what’s included.

What Types of Water Damage Does Homeowners Insurance Cover?

Water damage in a basement can stem from many sources, and whether insurance covers it depends on the cause. Generally, homeowners insurance covers sudden and accidental events but excludes preventable and external issues.

Covered Water Damage:

If the water damage happens suddenly and is accidental, your insurance will likely cover it. Examples include:

- Burst pipes – If a pipe suddenly bursts due to freezing temperatures or unexpected failure, the damage is typically covered.

- Overflowing appliances – Water damage from a broken washing machine, dishwasher, or water heater is usually included in coverage.

- Sudden plumbing failures – If a sewer backup rider is added, insurance may cover sewer overflows.

- Storm-related damage – If wind or hail damages your roof, leading to water entering your basement, your policy might cover repairs.

Not Covered:

Insurance does not cover damage resulting from neglect, poor maintenance, or external water sources. This includes:

- Flooding – If water enters your basement due to rising groundwater, heavy rains, or storm surges, you’ll need separate flood insurance.

- Seepage or slow leaks – If a pipe or foundation slowly leaks over time, causing mold or structural damage, insurance won’t cover it.

- Sump pump failure – Unless you have an additional water backup rider, damage from a failed sump pump is not covered.

Does Flood Insurance Cover Basement Water Damage?

Flood insurance covers water damage caused by external flooding, which is excluded from standard homeowners insurance. However, not all basement damage is covered even with a flood policy.

What Flood Insurance Covers in a Basement:

- Structural elements – Foundation, walls, and staircases.

- Essential systems – Electrical, plumbing, and HVAC systems.

- Certain built-in features – Water heaters, circuit breakers, and fuel tanks.

What It Doesn’t Cover:

- Personal belongings – Furniture, electronics, and stored items usually aren’t covered.

- Finished basement elements – Carpeting, drywall, and personal improvements often aren’t included.

If your basement is prone to flooding, it’s crucial to understand these limitations and invest in proper drainage solutions.

How to File an Insurance Claim for Basement Water Damage

Filing a successful claim for basement water damage requires proper documentation and a clear explanation of the cause. Insurers will scrutinize whether the damage is covered under your policy.

Steps to Take:

- Stop the damage – Shut off the water source if possible and prevent further destruction.

- Document everything – Take clear photos and videos of the damage before cleanup.

- Call your insurer immediately – Report the damage promptly and provide a detailed description.

- Get professional assessments – A public adjuster or contractor can evaluate the damage and provide repair estimates.

- Prevent further loss – Take temporary measures like water extraction to prevent mold and structural damage.

If your claim is denied, a public adjuster can help negotiate with your insurance provider and maximize your settlement.

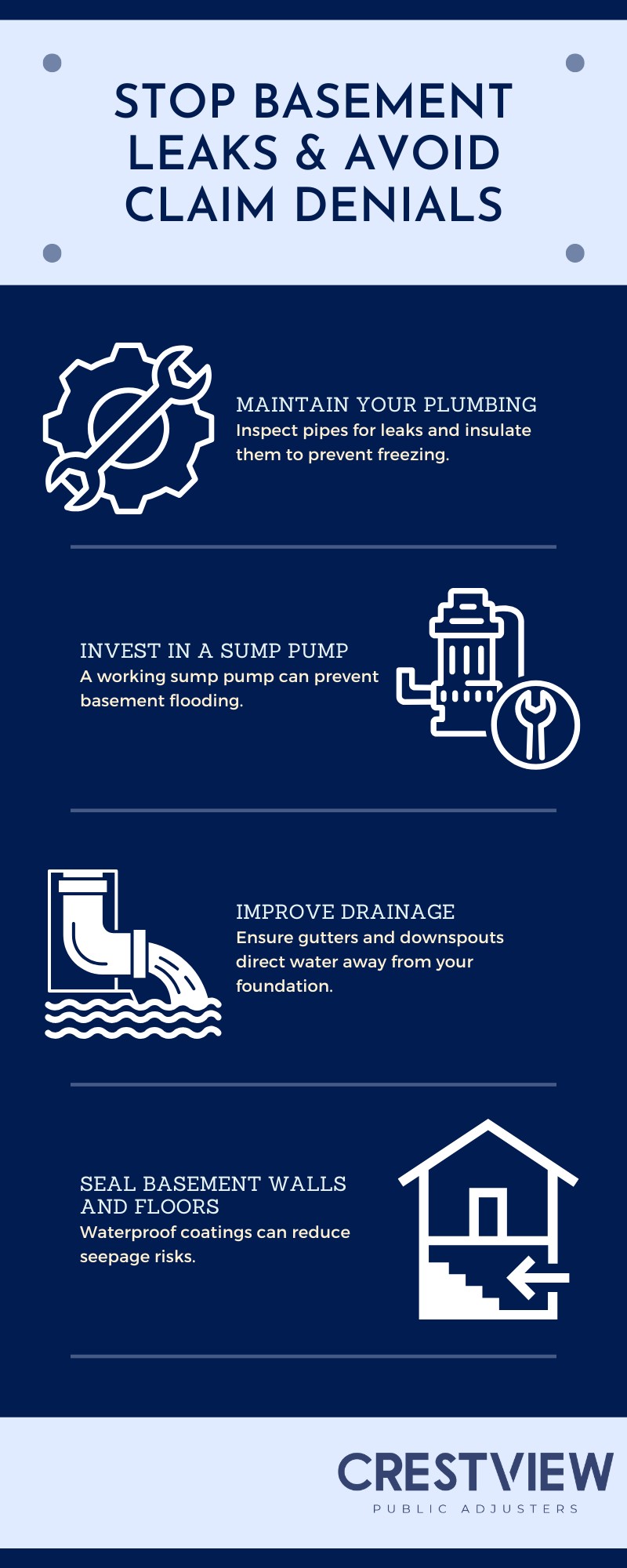

How to Prevent Basement Water Damage and Insurance Denials

Preventing water damage is crucial, as insurers often deny claims due to lack of maintenance or pre-existing issues. Proactive steps can help keep your basement dry and your claims valid.

Regular maintenance not only protects your home but also strengthens your case if you ever need to file an insurance claim.

Get Expert Help for Water Damage Claims

Dealing with basement water damage? Crestview Public Adjusters can help you navigate the claims process and get the compensation you deserve. Our experts specialize in water damage claims in Florida, New Jersey, and New York, ensuring you receive a fair payout.

Don’t settle for less—contact Crestview Public Adjusters today!