Key Points:

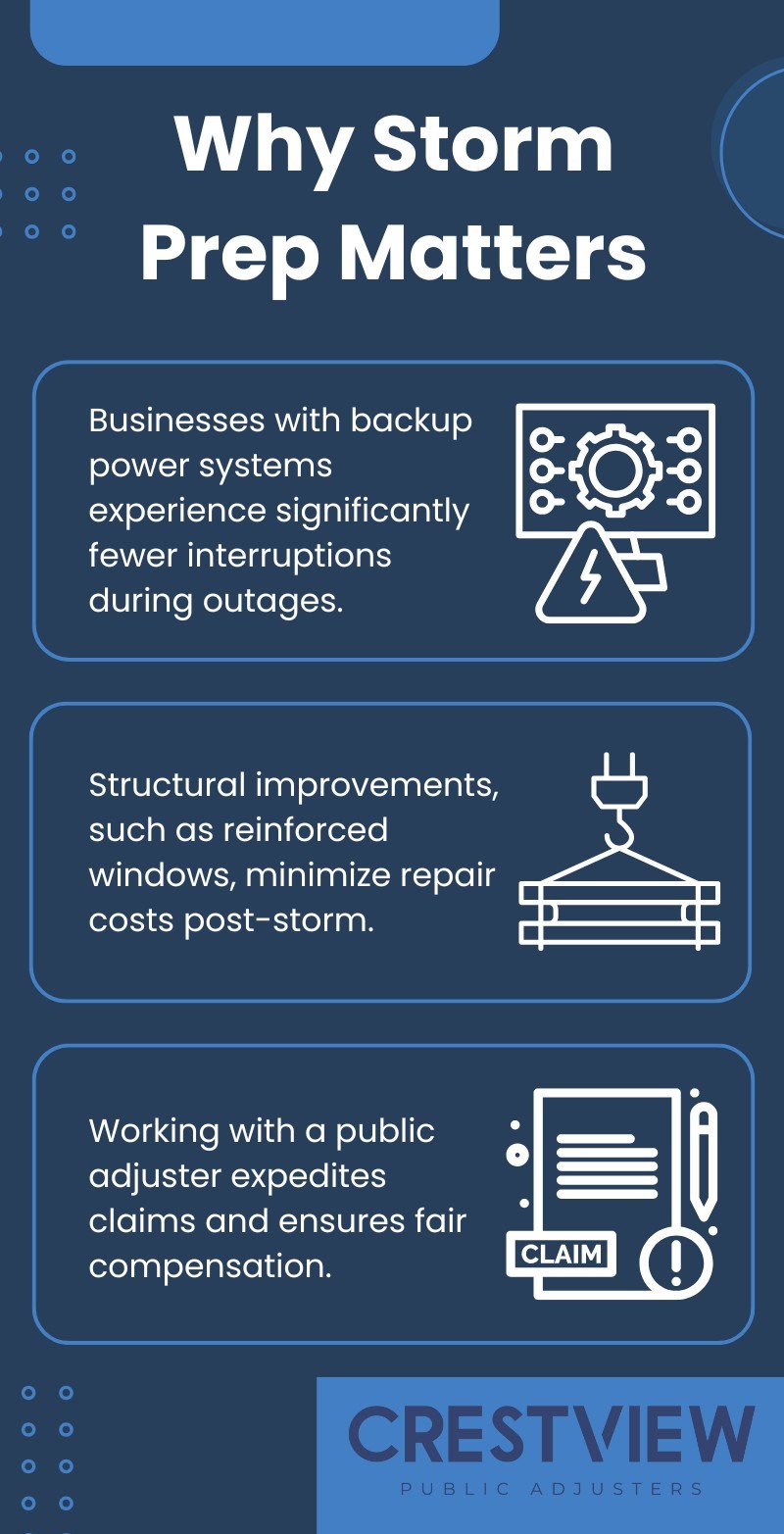

- Storm-related downtime can lead to massive financial and operational setbacks for businesses.

- Preventative measures, including structural inspections, proper insurance coverage, and a disaster recovery plan, minimize risks.

- Public adjusters like Crestview can ensure fair compensation for storm-related damage claims.

Did you know that 40% of businesses never reopen after a disaster, according to the Federal Emergency Management Agency (FEMA)? Storms, especially in areas like New York, can wreak havoc on commercial properties, leading to costly downtime.

Preparing your business ahead of time can significantly mitigate storm damage and keep operations running smoothly. In this guide, we’ll discuss how downtime prevention can safeguard your business and save you from potential financial disaster.

What is Downtime Prevention?

Downtime prevention refers to proactive measures taken by businesses to minimize interruptions caused by unforeseen events like storms, floods, or power outages.

Effective downtime prevention strategies involve strengthening infrastructure, adopting comprehensive insurance policies, and implementing disaster recovery plans. These measures help businesses maintain continuity, protect employees, and secure revenue. Without preparation, even a short disruption can result in significant losses.

For example, if a storm damages your facility, delays in repairs or insurance claims could halt operations for weeks. By preparing in advance, you reduce risks and ensure your business can recover faster.

How Storm Damage Affects Businesses

Storm damage isn’t just physical—it can impact every aspect of your business.

- Operational Delays

Damage to buildings or critical equipment can halt operations for days or weeks. For businesses with tight schedules, this downtime can lead to lost revenue and dissatisfied customers. - Financial Losses

Costs for repairs, temporary closures, and lost productivity pile up quickly. Many small businesses lack the resources to absorb these losses without assistance. - Reputational Damage

Repeated delays or inability to deliver services can harm your reputation. Clients may turn to competitors if they perceive your business as unreliable.

Taking preventative steps ensures that your business remains resilient against these challenges.

Steps to Prevent Storm Damage

To prevent storm damage, secure outdoor items, maintain your roof and gutters, and install storm shutters or impact-resistant windows. Trim trees to remove weak branches and, in flood-prone areas, elevate your home or use sump pumps. Also, prepare an emergency kit and evacuation plan. These steps help protect your home during a storm.

1. Conduct Regular Property Inspections

One of the best ways to minimize storm damage is by assessing your property’s vulnerabilities. Look for weak spots such as:

- Roof leaks

- Damaged gutters

- Cracked windows or doors

Schedule routine maintenance to reinforce these areas before storm season. Investing in structural upgrades, like storm shutters and reinforced roofing, can make all the difference.

2. Develop a Disaster Recovery Plan

A disaster recovery plan outlines the steps your business will take during and after a storm to minimize downtime. Key elements of a good plan include:

- A list of emergency contacts

- Evacuation procedures for staff

- Backup systems for data storage

Test your plan regularly to ensure employees know their roles and that all processes function as intended.

3. Ensure Proper Insurance Coverage

Having the right insurance is crucial. Policies that specifically cover storm-related damages reduce out-of-pocket expenses for repairs. Be sure to review your policy annually to confirm it meets your needs.

These proactive steps enhance your resilience, helping you recover faster and maintain customer trust.

What to Do After Storm Damage Occurs

After a storm, stay safe and avoid hazards. Document the damage with photos and contact your insurance company. If needed, hire a restoration service for repairs and keep receipts for temporary fixes.

1. Document the Damage

Take photos and videos of affected areas immediately after the storm. This documentation strengthens your insurance claim and ensures you receive adequate compensation.

2. Contact Your Insurance Provider

File your claim as soon as possible. Delays may complicate the claims process or reduce your payout.

3. Work with a Public Adjuster

Public adjusters specialize in maximizing your insurance claim. They evaluate damages, negotiate with insurers, and handle the paperwork so you can focus on resuming operations.

Prevent Downtime with the Right Support

Reliable IT support prevents downtime by addressing issues early. Proactive monitoring and quick troubleshooting keep your systems efficient, minimizing disruptions and allowing you to focus on your business.

1. Partner with Experts

Consider working with consultants who specialize in disaster preparedness. They can identify risks and recommend tailored solutions for your business.

2. Leverage Technology

Use storm tracking apps, backup power systems, and cloud storage to protect your operations. These tools enhance your ability to respond quickly during emergencies.

3. Train Your Staff

Employee training ensures everyone knows how to respond during a storm. Conduct regular drills to improve coordination and minimize panic.

Secure Fair Claims for Storm Damage in New York

Storms can disrupt operations, damage property, and lead to significant downtime. Having a public adjuster on your side ensures you get the compensation you deserve, helping you recover faster and stronger.

Crestview, specializes in Winter Damage Claims. Our team of experienced public adjusters in New York, navigates the complexities of insurance so you can focus on your business. From assessing damages to negotiating with insurers, we’re here to help.

Don’t let storm damage sideline your business. Contact Crestview today to protect your assets and keep downtime to a minimum.