Key Points:

- Many fire damage claims get undervalued or denied due to policy loopholes and insurer tactics.

- Understanding coverage, documenting damage thoroughly, and negotiating properly can significantly increase your payout.

- Hiring a public adjuster helps policyholders navigate complex claims and fight for fair compensation.

Fire and smoke damage insurance does not cover all losses. Coverage varies by policy and may exclude certain damages, such as those caused by negligence, arson, or pre-existing conditions. However, most policies cover structural damage, personal belongings, and additional living expenses if your home becomes uninhabitable. To ensure maximum compensation, review your policy carefully and document all losses.

Understanding Your Fire & Smoke Damage Insurance Coverage

Fire damage insurance policies seem straightforward—covering damage to your home and belongings—but the fine print can make or break your claim. Insurance companies often limit payouts based on exclusions, depreciation, or vague policy language, which leaves homeowners with unexpected out-of-pocket costs.

Fire and smoke damage claims typically cover:

- Structural Damage – This includes damage to walls, floors, ceilings, and built-in fixtures. Policies often cover repair or rebuilding costs, but some may apply depreciation based on the home’s age and condition.

- Personal Property Loss – Items like furniture, electronics, and clothing are covered, but insurers may apply actual cash value (ACV) rather than replacement cost value (RCV), which can reduce payouts.

- Additional Living Expenses – If a fire renders your home uninhabitable, ALE provides coverage for temporary housing, food, and essential living costs. Keep in mind that insurers impose limits, so it’s important to monitor your expenses closely.

Understanding these aspects helps prevent disputes and ensures that policyholders receive the full amount they’re entitled to.

How to Maximize Your Fire & Smoke Damage Insurance Claim

Filing a fire damage claim is one thing—getting the full payout is another. Insurers look for ways to minimize payouts, often by using complex policy language, lowballing repair estimates, or delaying the claims process. Here’s how to counter those tactics:

1. Document Everything Immediately

Before cleaning up, take extensive photos and videos of the damage. Capture:

- Structural damage, including ceilings, walls, and floors

- Smoke-stained furniture, electronics, and personal belongings

- Water damage from firefighting efforts

- Any receipts or estimates for damaged high-value items

Keep a written inventory of losses and gather purchase receipts, if available. The more proof you have, the harder it is for insurers to deny or undervalue your claim.

2. Review Your Policy in Detail

Many homeowners are unaware of exclusions, deductibles, or coverage limits until they file a claim. Review your policy carefully to understand:

- Whether you have ACV or RCV coverage for personal property

- Specific exclusions for smoke damage or secondary issues like water damage

- Any limitations on ALE reimbursements

Knowing your policy inside and out helps you push back against unfair claim reductions.

3. Get a Professional Damage Assessment

Insurance adjusters work for the insurer, not you. They may downplay damage or omit necessary repairs. Hiring an independent contractor or a public adjuster ensures you receive an objective assessment of the true cost of repairs.

4. Don’t Accept the First Offer

Insurance companies often start with a low settlement offer, hoping you’ll accept without question. Always negotiate. If the amount doesn’t cover the full cost of repairs, provide a counteroffer backed by damage assessments and repair estimates.

5. Keep All Communication in Writing

Verbal assurances from your insurer mean nothing without documentation. Get everything in writing, including claim updates, damage estimates, and settlement offers. This protects you if disputes arise later.

What Can Cause a Fire & Smoke Damage Claim to Be Denied?

Denied claims are more common than you might think, often due to technicalities or misinterpretations of policy language. Here are the most common reasons:

- Insufficient Documentation – Without proof of damage, insurers may claim the losses aren’t covered.

- Disputes Over Cause of Fire – If the insurer suspects negligence or arson, they may deny the claim entirely.

- Policy Exclusions – Some policies exclude smoke damage, secondary water damage, or specific fire sources.

- Missed Deadlines – Many policies require claims to be filed within strict time limits.

To prevent denials, document everything thoroughly and file your claim as soon as possible. If a claim is wrongfully denied, a public adjuster can help dispute the decision.

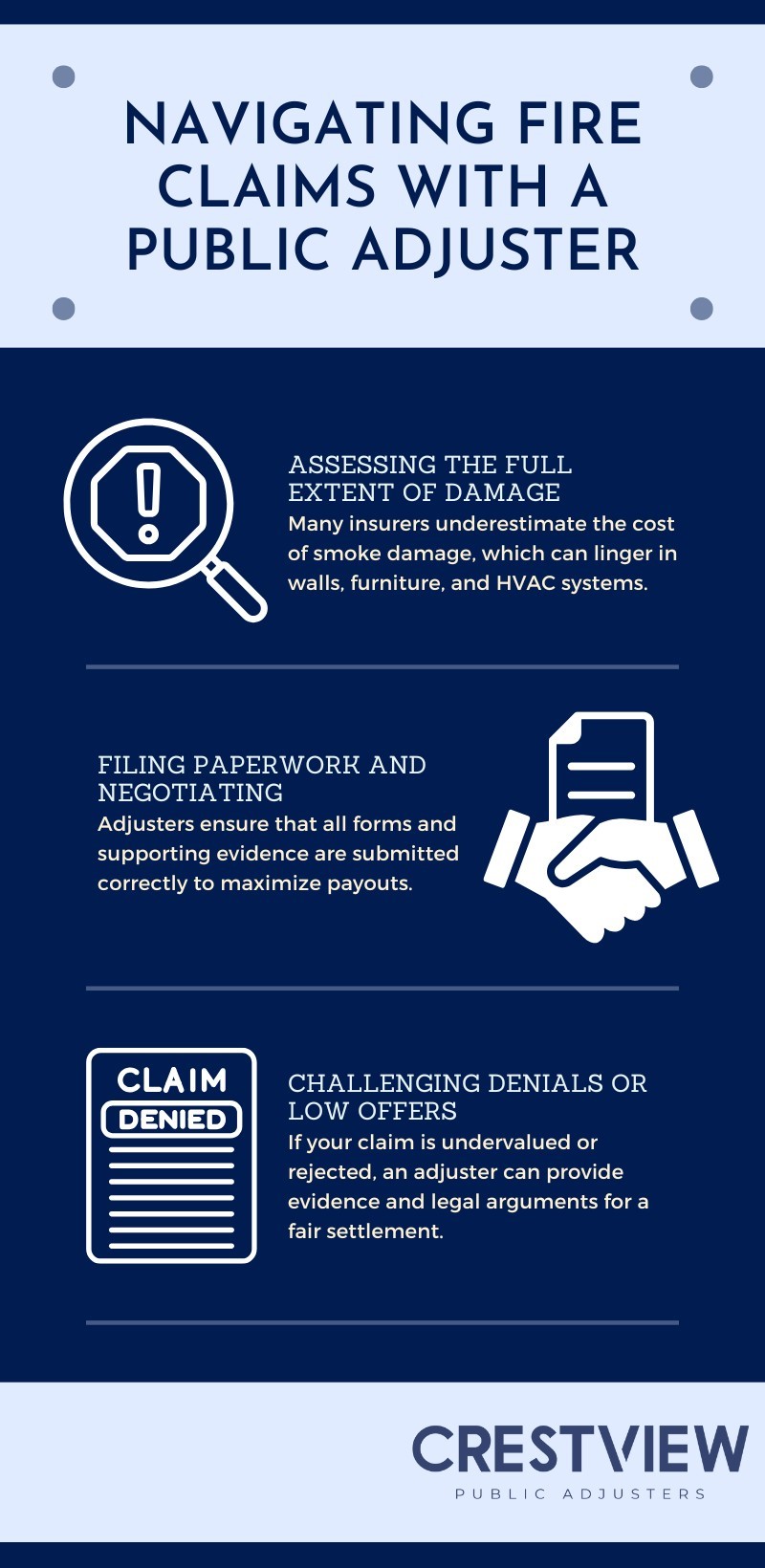

The Role of a Public Adjuster in Fire & Smoke Damage Claims

Public adjusters specialize in negotiating fair settlements on behalf of policyholders, not insurance companies. They handle the claims process from start to finish, including:

Many policyholders recover significantly higher payouts when working with an experienced public adjuster.

Get Expert Help for Your Fire Damage Claim

If you’re dealing with fire smoke damage insurance claims, don’t navigate the process alone. Crestview Public Adjusters fights for policyholders in New York, Florida, and New Jersey to ensure they receive the compensation they deserve. Our experienced adjusters handle everything—from documentation to negotiation—so you don’t have to.

Maximize your payout. Contact Crestview Public Adjusters today for a free consultation.