Key Points:

- Frozen pipe insurance coverage can help policyholders recover financial losses from pipe bursts, including property damage and water remediation costs.

- Coverage depends on policy details, exclusions, and the insurer’s assessment of maintenance negligence.

- Working with a public adjuster ensures fair claim settlements and maximized payouts.

Most homeowners and commercial property insurance policies cover damage from frozen pipes, but exclusions and limitations may apply. Coverage typically includes repairs for water damage resulting from burst pipes, but insurers may deny claims if negligence, such as inadequate heating, contributed to the issue. Reviewing policy terms and acting promptly when pipes freeze is crucial to ensuring coverage.

Frozen pipes are a major concern for property owners in colder regions. According to the Insurance Information Institute, water damage and freezing accounted for nearly 30% of all homeowners insurance claims in a recent year. When pipes freeze and burst, they can cause extensive damage to walls, floors, and personal belongings. Without proper coverage, the financial burden can be overwhelming.

What Does Frozen Pipe Insurance Cover?

Insurance coverage for frozen pipes varies by policy, but most standard plans include:

- Water damage repairs – Covers damage to walls, ceilings, floors, and belongings caused by leaking or burst pipes.

- Pipe repair and replacement – Some policies cover the cost of fixing or replacing frozen pipes, while others exclude this.

- Mold remediation – If water damage leads to mold growth, some policies provide coverage for removal and repairs.

- Temporary housing expenses – If the home becomes uninhabitable due to severe water damage, additional living expenses may be covered.

While these coverages are common, every policy is different. Some insurers may refuse claims if they determine that homeowners failed to maintain adequate heating or insulation. Reviewing the policy’s fine print helps avoid unexpected claim denials.

Does Homeowners Insurance Cover Burst Pipes?

Yes, most homeowners insurance policies cover burst pipes if the damage is sudden and accidental. However, insurers may reject claims if they find:

- Negligence – If the homeowner failed to keep the home heated or ignored maintenance issues, coverage might be denied.

- Gradual damage – Some insurers exclude slow leaks, arguing that the homeowner should have detected and fixed the issue earlier.

- Certain exclusions – Some policies exclude damage from frozen pipes in unoccupied homes unless special precautions were taken.

To strengthen a claim, homeowners should document damage immediately, take photos, and prevent further deterioration while awaiting an adjuster’s assessment.

How to File a Frozen Pipe Insurance Claim

Filing a claim for frozen pipe damage requires attention to detail to avoid delays or denials. The process generally includes:

- Document the damage – Take clear photos and videos of the affected areas before making any repairs.

- Mitigate further damage – Shut off the water supply and use temporary fixes to prevent additional loss.

- Review the insurance policy – Understanding coverage limits and exclusions helps set realistic expectations.

- Contact the insurer – Report the incident as soon as possible and provide necessary documentation.

- Work with a public adjuster – A public adjuster ensures fair valuation of damages and helps maximize claim payouts.

Acting quickly and providing thorough documentation can make the difference between a fully approved claim and a frustrating denial.

Common Reasons Insurance Claims for Frozen Pipes Get Denied

Insurance companies may deny frozen pipe claims for several reasons, including:

- Failure to maintain heat – If the homeowner neglected to keep the property warm, the insurer might argue that the damage was preventable.

- Unoccupied property – Policies often exclude claims for vacant homes unless specific precautions were taken.

- Pre-existing damage – If the insurer determines that the pipe was deteriorating before freezing, they may deny coverage.

- Policy exclusions – Some policies specifically exclude frozen pipe damage unless additional coverage was purchased.

Understanding these risks helps homeowners take preventive measures to ensure a successful claim.

How to Prevent Pipes from Freezing

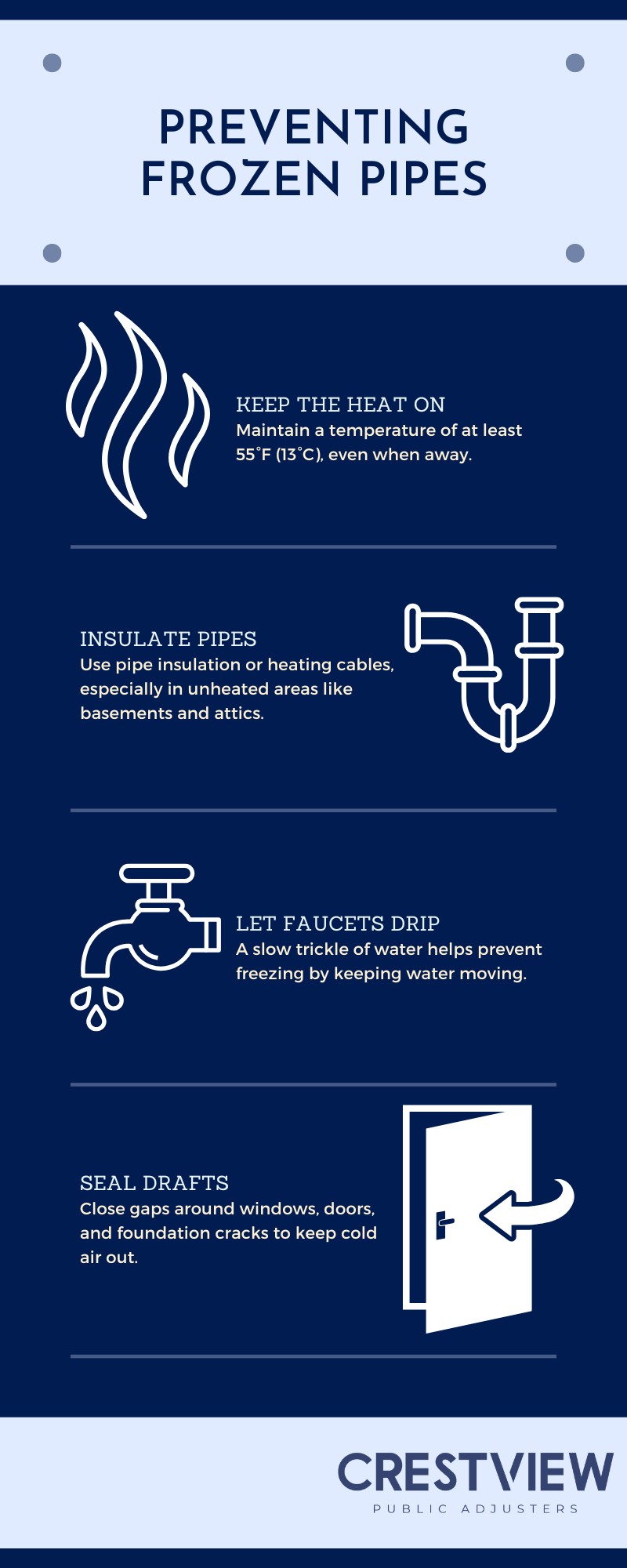

Preventing frozen pipes is the best way to avoid costly damage and insurance disputes. Key steps include:

Taking these precautions not only protects the home but also strengthens an insurance claim if damage occurs.

Get the Most from Your Frozen Pipe Claim with Crestview Public Adjusters

Navigating frozen pipe insurance coverage claims can be complicated, especially when insurers scrutinize maintenance records and policy exclusions. Working with a public adjuster ensures that policyholders receive fair compensation for their losses.

Crestview Public Adjusters specializes in frozen pipe claims in New Jersey, New York, and Florida. Our experts handle the entire claims process, from documentation to negotiations, ensuring that property owners receive the maximum payout their policy allows.

If frozen pipes have caused damage to your home or business, don’t settle for a lowball offer. Contact Crestview Public Adjusters today and let us fight for the compensation you deserve.