Key Points:

- Cyber insurance helps cover business losses and recovery costs from ransomware incidents, but policy terms and proof requirements are critical.

- Claimants must follow a clear, step-by-step process, including immediate breach reporting and detailed documentation.

- Working with public adjusters can improve outcomes by navigating complex claims and maximizing coverage.

According to IBM’s 2023 Cost of a Data Breach Report, ransomware attacks cost businesses an average of $5.13 million per incident—excluding the ransom itself. As cybercrime escalates in frequency and cost, more businesses are turning to cyber insurance to mitigate financial damage. But what happens when a ransomware attack strikes, and it’s time to file a claim?

Let’s break down exactly how cyber insurance claims work for ransomware attacks, what policyholders need to prepare for, and how to ensure you’re not left in the dark during a high-stakes recovery.

How Cyber Insurance Claims Work for Ransomware Attacks

Cyber insurance claims for ransomware attacks involve immediate incident reporting, forensic investigation, cost documentation, and insurer coordination to recover losses. Policies vary in scope, so eligibility depends on specific policy language and compliance with notification and documentation requirements.

What Does Cyber Insurance Cover in a Ransomware Attack?

Cyber insurance can provide a safety net during ransomware incidents, but coverage is not universal or automatic. Understanding what’s covered—before the crisis—can mean the difference between a smooth recovery and prolonged disruption.

Generally, a ransomware-focused cyber policy may cover the following:

- Ransom payments (including negotiation services)

- Business interruption losses from operational downtime

- Data recovery and restoration costs

- Forensic investigation and breach assessment

- Legal expenses related to notification, compliance, and liability

- Public relations and crisis management

- Third-party liabilities in case customer or partner data is exposed

But each policy has limitations. For example, some insurers exclude ransom payments made to sanctioned entities, while others may only cover business interruption if it exceeds a minimum time threshold. Pre-attack actions—like having updated backups or security controls—can also influence eligibility.

Always read the fine print, especially regarding waiting periods, exclusions, and sub-limits specific to ransomware.

What Is the Process for Filing a Cyber Insurance Claim After a Ransomware Attack?

Filing a ransomware claim involves more than just informing your insurer—it requires a methodical and well-documented approach. Most policies outline strict timelines and procedural requirements, and failing to follow them can jeopardize your payout.

Here’s a step-by-step breakdown:

Immediate Notification

You must notify your insurer as soon as you suspect or confirm an attack. Some policies require notification within 24 hours.

Contain the Breach

Work with your IT team or third-party cybersecurity firm to contain the threat. Insurers may offer access to pre-approved vendors.

Document Everything

Gather all logs, ransom notes, communication with attackers, screenshots, and timestamps. You’ll need this for your claim file.

Hire Forensic Experts

Most insurers require an independent forensic report. This helps identify the attack vector, scope of compromise, and impacted systems.

Estimate Financial Losses

Include all direct and indirect costs: downtime, lost revenue, ransom paid, legal expenses, etc. Use accounting records and system logs to back these up.

Submit the Claim

Once all documentation is ready, formally submit the claim. Include an incident report, financial impact, and any third-party reports.

Adjuster Review

The insurer assigns an adjuster to review the submission. They may request interviews, additional documentation, or follow-ups.

Settlement and Reimbursement

If approved, the insurer will release the reimbursement (minus deductibles and within coverage limits). Disputes may require further negotiation or mediation.

What Are the Common Pitfalls That Delay or Deny Claims?

Even if you follow the right steps, cyber insurance claims for ransomware attacks can still be delayed or denied. The fine print in your policy—and how you handled the attack—makes all the difference.

Here are common mistakes:

- Delayed Notification: Not reporting within the required timeframe can invalidate the claim.

- Unauthorized Ransom Payment: Some insurers won’t cover ransom if you don’t consult them or use approved vendors.

- Inadequate Documentation: Missing logs, incomplete reports, or poor record-keeping can weaken your claim.

- Non-Compliance with Security Standards: If you failed to maintain agreed-upon cybersecurity protocols (e.g., MFA, backups), the insurer may deny coverage.

- Improper Vendor Use: Using unapproved IT or forensic vendors can conflict with your policy terms.

- Exclusion Clauses: Some policies exclude coverage for certain types of malware or nation-state actors.

Always verify your policy’s exclusions and obligations. If your claim is denied, public adjusters can help advocate on your behalf and reopen negotiations.

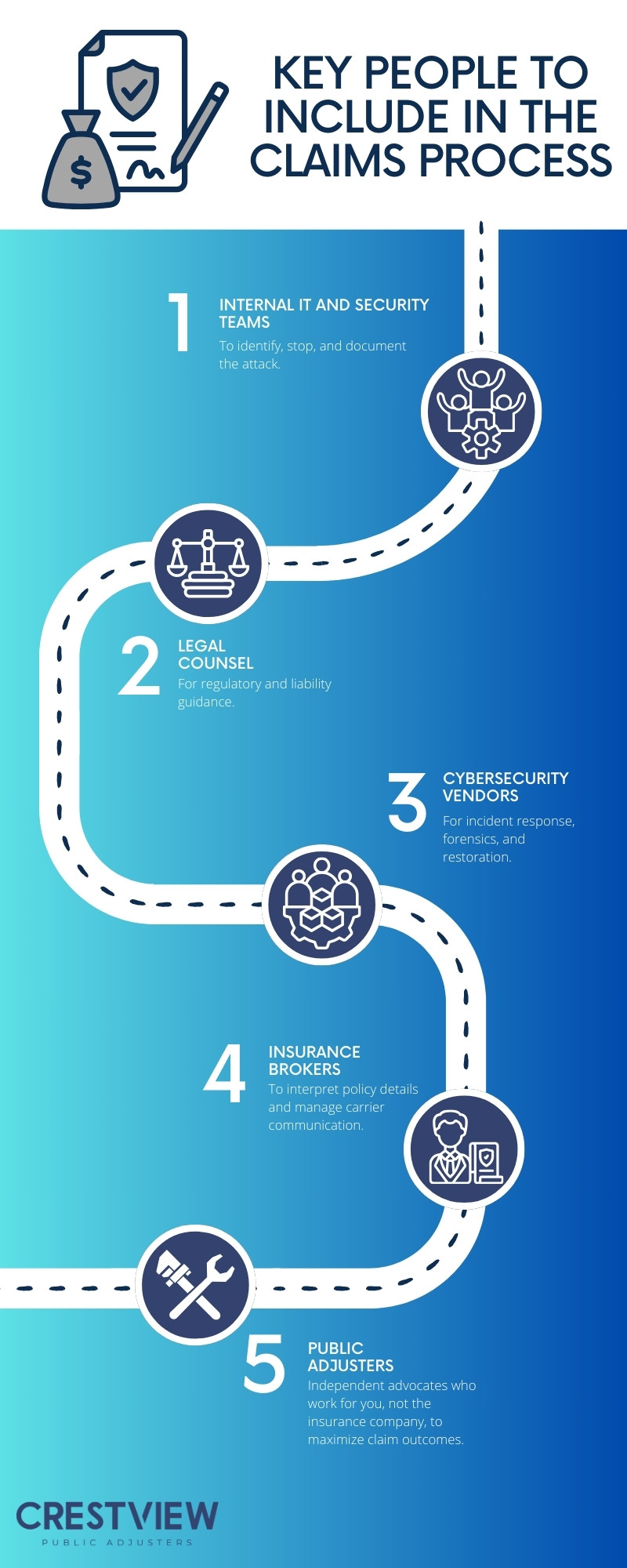

Who Should Be Involved in the Claims Process?

Cyber insurance claims aren’t just handled by the policyholder and the insurer. Multiple parties may need to be involved to resolve the case efficiently.

These typically include:

Because ransomware attacks are often chaotic and complex, coordination is key. Having a structured response plan ahead of time makes this easier.

Do You Need to Pay the Ransom to File a Claim?

Not necessarily. Most cyber insurance policies do not require you to pay a ransom to receive benefits; however, they do expect a sound justification if you choose to do so. Insurers may cover ransom payments under certain conditions, such as when the payment is legally permissible (i.e., not made to a sanctioned entity), necessary to regain access to critical data or systems, and made in consultation with the insurer. Additionally, the payment must be properly documented, including details like wallet addresses, amounts, and communication records. That said, many insurers also offer decryption tools or negotiation services, making it crucial to engage them as early as possible. Paying a ransom without first notifying your insurer could result in a denied claim.

What Documentation Do You Need for a Ransomware Claim?

Insurers won’t release funds without proof. You’ll need to provide comprehensive documentation to validate your claim. This includes:

- Incident report (timeline, cause, impact)

- Forensic investigation report

- Screenshots of ransom messages

- Payment proof (if ransom was paid)

- Log files and system audits

- Downtime logs and productivity metrics

- Invoices for legal, IT, or PR services

- Internal emails or memos about operational impact

The more detailed and organized your documentation is, the faster the process moves. Keep backups of everything.

What’s the Role of a Public Adjuster in Cyber Insurance Claims?

Cyber insurance claims—especially those involving ransomware—can become complicated quickly. Public adjusters serve as independent advocates for policyholders, helping them prepare, present, and negotiate claims. Unlike adjusters who work for insurance companies, public adjusters represent only your interests. They interpret your policy to ensure full use of your coverage, compile documentation in insurer-accepted formats, challenge low settlement offers or denied claims, and coordinate with forensics, legal, and IT professionals when needed.

Their expertise in navigating complex claims language and understanding insurer tactics is especially valuable during high-stakes or high-value ransomware attacks. With a public adjuster on your side, you can reduce the time spent on the claims process and increase the likelihood of a favorable payout.

Call the Experts in Cyber Insurance Claims

Ransomware attacks can be overwhelming—but your insurance claim doesn’t have to be. At Crestview Public Adjusters, we specialize in representing policyholders through the complex world of cyber insurance claims for ransomware attacks. Serving Florida, New Jersey, and New York, we help businesses interpret their coverage, compile the necessary documentation, and fight for the full payout they’re entitled to.

Let our team navigate the claims process for you—so you can focus on recovery, not red tape. Contact Crestview Public Adjusters today.