Key Points:

- Smoke damage is typically covered by homeowners or renters insurance if caused by a sudden and accidental event, such as a fire.

- Coverage may include damage to your property, belongings, and the cost of temporary living arrangements.

- It’s crucial to understand your policy’s terms, exclusions, and claim process to maximize compensation.

Did you know that the United States Fire Administration reported over 350,000 residential fires annually, causing billions in damages? While fire damage is devastating, smoke damage can be equally destructive. It infiltrates walls, furniture, and electronics, often leading to long-term consequences. But is smoke damage covered by insurance? This article dives into the specifics of insurance coverage for smoke damage and what you, as a policyholder, need to know to protect your property and finances.

Is Smoke Damage Covered by Insurance?

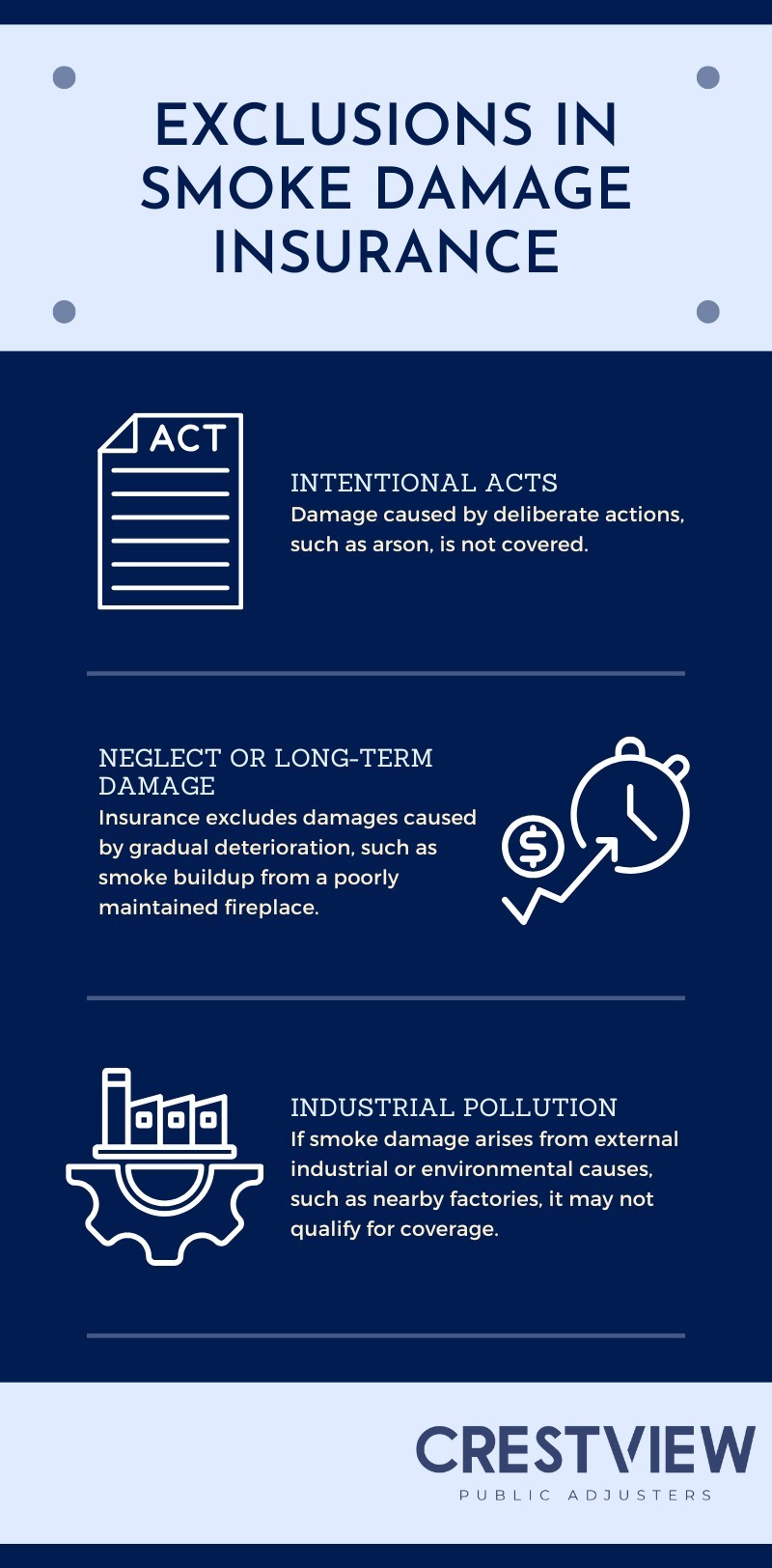

Yes, most homeowners or renters insurance policies cover smoke damage, provided it results from a covered peril like a fire. Coverage typically extends to structural damage, personal belongings, and additional living expenses incurred during repairs. However, claims may be denied if the damage is linked to excluded events, such as intentional fires or long-term neglect.

Insurance companies classify smoke damage as part of fire-related coverage. This means that if your home or belongings suffer smoke damage from a sudden, accidental event, such as a kitchen fire or wildfire, your policy will likely compensate you for cleanup, repairs, and replacements. Always check your policy’s terms and conditions for specific details.

What Types of Smoke Damage Does Insurance Cover?

Not all smoke damage is the same. Understanding the types of damage your insurance covers helps avoid surprises when filing a claim.

- Structural Damage – Smoke can seep into walls, ceilings, and ventilation systems, causing discoloration and odors. Your policy often covers repairs or cleaning for these structural elements.

- Personal Belongings – Items like furniture, clothing, and electronics affected by smoke may also be covered. Your policy could reimburse you for cleaning costs or replacement of irreparably damaged items.

- Loss of Use – If your home becomes uninhabitable due to smoke damage, your insurance may cover temporary housing and additional living expenses under “loss of use” coverage.

- Professional Cleaning Services – Insurance often includes the cost of hiring smoke damage restoration professionals, as cleaning soot and odor requires specialized equipment.

Understanding these exclusions can save you time and frustration during the claims process.

How to File a Smoke Damage Insurance Claim

Filing a claim for smoke damage involves several critical steps. Here’s what you should do:

- Document the Damage – Take photos or videos of all affected areas and items. Detailed evidence strengthens your claim.

- Contact Your Insurance Company – Notify your insurer immediately to start the claims process. Be prepared to provide details about the incident and the extent of the damage.

- Mitigate Further Damage – While waiting for the adjuster, take steps to prevent additional damage, such as covering exposed areas or removing soot from surfaces.

- Get Professional Estimates – Hire restoration experts to assess repair and cleaning costs. These estimates will help during claim negotiations.

- Consult a Public Adjuster – If your claim becomes complicated or you feel undercompensated, a public adjuster can advocate on your behalf to maximize your settlement.

Why Work with a Public Adjuster for Smoke Damage Claims?

Smoke damage claims can be complex, with insurers often disputing the extent of coverage or payout amounts. Public adjusters specialize in navigating insurance policies and advocating for policyholders. They ensure all damages are accounted for, from structural repairs to personal belongings and additional living expenses.

Hiring a public adjuster minimizes stress and increases the likelihood of a fair settlement, especially for intricate smoke damage cases.

Command Your Smoke Damage Coverage Today

Dealing with smoke damage can feel overwhelming, but you don’t have to handle it alone. At Crestview Public Adjusters, we help policyholders in New York, New Jersey, and Florida secure the compensation they deserve. Our team ensures no detail goes unnoticed, maximizing your claim for smoke damage. Contact us today to take the first step toward a successful claim!