Key Points:

- Water damage is a leading cause of property insurance claims, with billions paid out annually.

- Common types of water damage claims include pipe bursts, roof leaks, and appliance malfunctions.

- Understanding policy coverage and working with a public adjuster can help maximize claim payouts.

Water damage claims are among the most frequent homeowner insurance claims, costing insurers billions of dollars each year. They result from various sources, including plumbing failures, storm-related leaks, and faulty appliances. Understanding the most common causes can help homeowners take preventive measures and ensure proper insurance coverage.

1. Burst and Leaking Pipes

A single burst pipe can release hundreds of gallons of water per hour, causing structural damage, mold growth, and electrical hazards. Pipe-related water damage is one of the most frequently reported claims, especially in colder climates where freezing temperatures can cause pipes to crack and burst.

Common causes of pipe-related water damage:

- Frozen pipes – When water inside pipes freezes, it expands and increases pressure, leading to cracks or full bursts.

- Corrosion and aging – Older pipes degrade over time, making them more prone to leaks.

- High water pressure – Excessive pressure can strain pipes, causing them to weaken and eventually rupture.

Insurance policies often cover sudden and accidental pipe bursts but may exclude damage resulting from neglected maintenance or slow leaks. Homeowners should regularly inspect pipes, insulate them in winter, and monitor water pressure to prevent costly claims.

2. Roof Leaks and Storm Damage

A compromised roof is a major entry point for water damage. Whether due to storm damage, aging materials, or poor installation, roof leaks can lead to interior water damage, mold infestations, and ceiling collapses.

Factors contributing to roof-related water damage:

- Severe weather – Heavy rain, hail, and strong winds can damage shingles, leading to leaks.

- Poor maintenance – Clogged gutters, missing shingles, and cracked flashing create vulnerabilities.

- Ice dams – In colder regions, ice dams form when melting snow refreezes at the roof’s edge, trapping water and causing leaks.

Insurance typically covers damage from sudden events like storms but may not cover wear-and-tear-related leaks. Homeowners should schedule annual roof inspections and clear gutters to prevent unnecessary damage.

3. Appliance and Plumbing Failures

Household appliances and plumbing fixtures are frequent culprits of water damage, often causing significant losses when they malfunction unexpectedly.

Common sources of appliance-related water damage:

- Washing machines – Worn-out hoses can rupture, causing floods.

- Water heaters – Sediment buildup and aging tanks lead to leaks or bursts.

- Dishwashers and refrigerators – Faulty seals and clogged drains can result in slow but continuous leaks.

Most insurance policies cover sudden appliance failures but exclude gradual damage caused by neglect. Routine maintenance, replacing hoses, and checking seals can reduce the risk of claims.

4. Sewer Backups and Drain Overflows

Sewer backups are among the most unpleasant and hazardous types of water damage claims. When sewage flows back into a home through toilets, drains, or sinks, it can cause widespread contamination and require extensive sanitation efforts.

Causes of sewer backups:

- Tree root intrusion – Roots can invade sewer lines, causing blockages.

- Aging sewer systems – Older pipes deteriorate, increasing the risk of backups.

- Heavy rain and flooding – Excess water can overload municipal sewer systems, forcing waste back into homes.

Standard homeowners insurance policies typically exclude sewer backups unless additional coverage is purchased. Installing backflow valves and avoiding flushing non-biodegradable materials can help prevent these incidents.

5. Basement Flooding and Foundation Leaks

Basement water damage is a common problem, especially in areas with high groundwater levels or poor drainage systems. Water can seep through foundation cracks, flood basements, and damage belongings stored in lower levels.

Key causes of basement water intrusion:

- Poor drainage – Clogged gutters and improper grading can direct water toward the foundation.

- Sump pump failures – A broken or overwhelmed sump pump can lead to flooding.

- Hydrostatic pressure – Excessive groundwater pressure forces water through cracks in basement walls and floors.

Most homeowners insurance policies exclude flooding from rising groundwater unless separate flood insurance is purchased. Keeping gutters clear, installing a backup sump pump, and sealing foundation cracks can help mitigate risks.

6. HVAC and Air Conditioning Leaks

Heating, ventilation, and air conditioning (HVAC) systems can be a hidden source of water damage if not properly maintained. Clogged condensate drain lines and malfunctioning units can lead to slow leaks, causing water buildup in walls, ceilings, or floors.

Common HVAC-related water damage issues:

- Blocked drain lines – Dust, debris, and algae growth can clog drains, causing overflow.

- Frozen evaporator coils – Coils can freeze due to poor airflow or refrigerant issues, leading to water leaks when they thaw.

- Poor insulation – Condensation can form on ductwork, dripping onto insulation and drywall.

Homeowners can prevent HVAC-related water damage by cleaning drain lines, changing air filters regularly, and scheduling professional maintenance checks.

7. Accidental Overflow and Negligence

Unintentional water overflows from bathtubs, sinks, or toilets can cause extensive damage, especially if left unattended for hours.

Common scenarios leading to accidental overflows:

- Leaving taps running – Forgetting to turn off a faucet can flood bathrooms and adjacent rooms.

- Toilet malfunctions – Faulty float valves or clogged drains can lead to overflows.

- Children or pets – Curious kids or pets can accidentally turn on taps or knock over water containers.

Most homeowners insurance policies cover sudden and accidental overflows but may deny claims if negligence is proven. Installing water sensors and being mindful of running water can help prevent accidents.

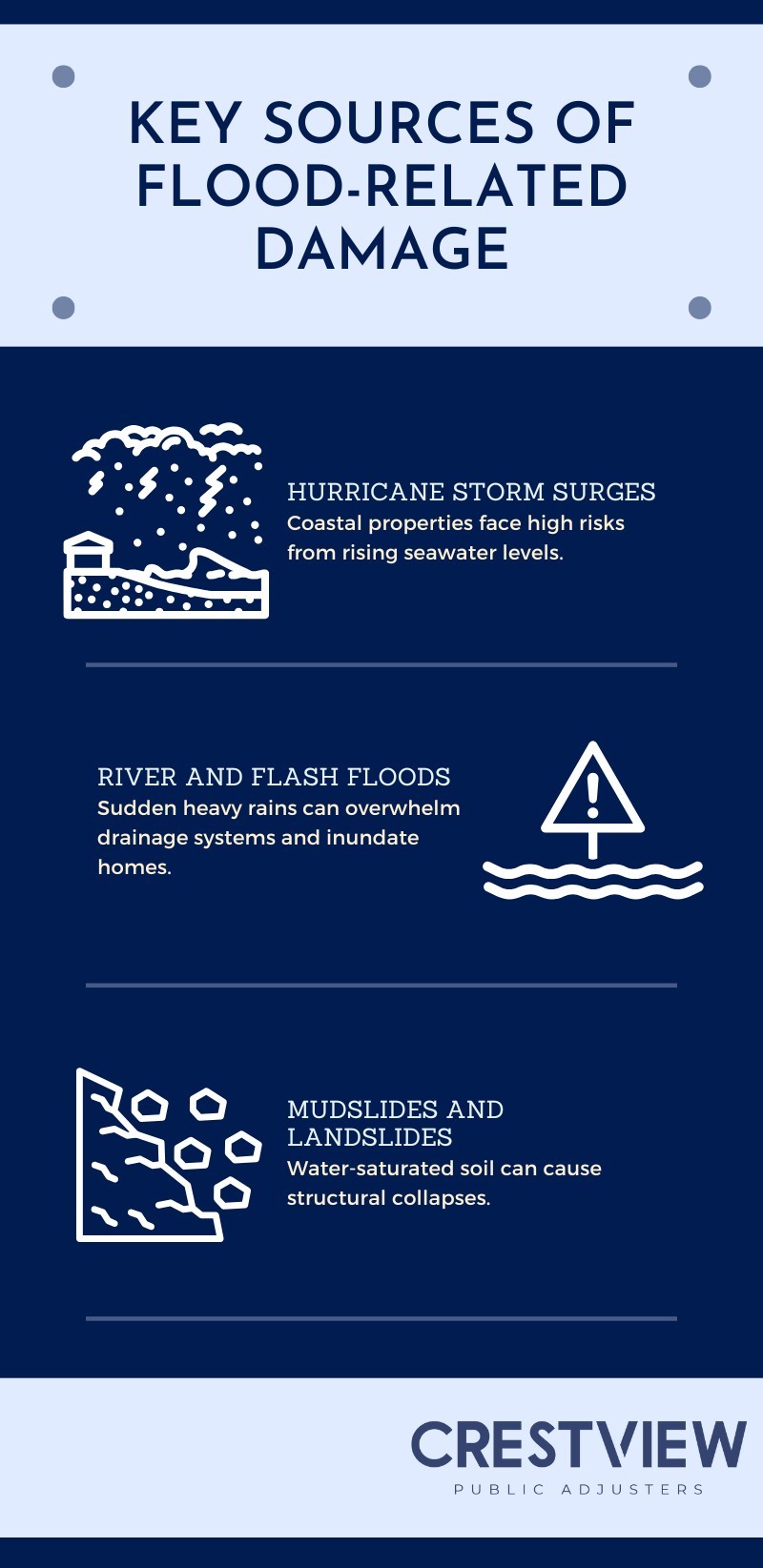

8. Natural Disasters and Flood Damage

Flood damage is distinct from typical water damage claims, as it usually requires separate insurance coverage. Flash floods, hurricanes, and heavy rains can submerge homes, destroy electrical systems, and render properties uninhabitable.

Standard homeowners insurance excludes flood damage, requiring a separate flood insurance policy through the National Flood Insurance Program (NFIP) or private insurers.

Get the Maximum Payout for Your Water Damage Claim

Filing a water damage claim can be complicated, and insurance companies often minimize payouts by citing policy exclusions or depreciation. Crestview Public Adjusters specializes in helping homeowners in New York, New Jersey, and Florida navigate water damage claims, ensuring fair compensation for repairs and losses.

With our expertise in Winter Damage Claims, we assess the full scope of damage, negotiate with insurers, and maximize your settlement. Don’t settle for less—let us handle your claim and secure the payout you deserve. Contact Crestview today to get started.