How Public Adjusters Assist With Commercial Property Claims

Key Points: According to FEMA, about 25% of businesses that experience a significant property loss never reopen, largely due to insufficient claim settlements. Commercial insurance claims can be overwhelming, especially when operations are disrupted. This is where the expertise of a public adjuster becomes invaluable—advocating for the policyholder, not the insurance company. How Public Adjusters […]

The Benefits of Hiring a Public Adjuster for Business Owners

Key Points: Hiring a public adjuster can significantly increase the chances of receiving a fair and timely insurance settlement. Business owners who work with public adjusters typically receive higher payouts and avoid common pitfalls that can delay or reduce insurance claims. Why Business Owners Need More Than Just Insurance According to FEMA, over 40% of […]

The Role of a Public Adjuster After a Natural Disaster

Key Points: The role of a public adjuster after a natural disaster is to represent the policyholder—not the insurance company—by managing the entire claims process and securing the maximum possible payout based on the policy terms. Their job begins the moment damage is assessed and continues until a fair settlement is reached. Public adjusters are […]

Understanding the Property Damage Claims Process

Key Points: The property damage claims process involves documenting, filing, and negotiating a claim with your insurance provider after your property suffers damage. This includes understanding your policy coverage, notifying your insurer promptly, collecting detailed evidence, undergoing inspections, and settling on compensation. Being informed can significantly improve your outcome. Why Understanding the Property Damage Claims […]

How a Public Adjuster Can Maximize Your Insurance Payout

Key Points: Hiring a public adjuster can significantly increase your final insurance payout. They work solely on your behalf, unlike insurance company adjusters. With deep knowledge of policy language, damage assessment, and negotiation strategies, public adjusters help ensure you’re not shortchanged during the claims process. What Does a Public Adjuster Actually Do? Unlike insurance company […]

Public Adjuster vs Attorney: Where to Go?

Unsure whether to hire a public adjuster or an attorney? Learn their roles and choose the right expert to get the best insurance payout today!

Benefits of Hiring a Public Adjuster for Home Insurance Claim

A public adjuster helps you secure the highest payout for your home insurance claim while avoiding delays and denials. Get expert help today!

Can a Public Adjuster Work for a Contractor?

Public adjusters handle claims, while contractors do repairs. Laws prohibit them from working together to ensure fair settlements. Hire wisely!

Public Adjuster vs Private Adjuster: Key Differences

A public adjuster fights for policyholders, securing up to 747% higher payouts. Don’t settle for less—get expert help now!

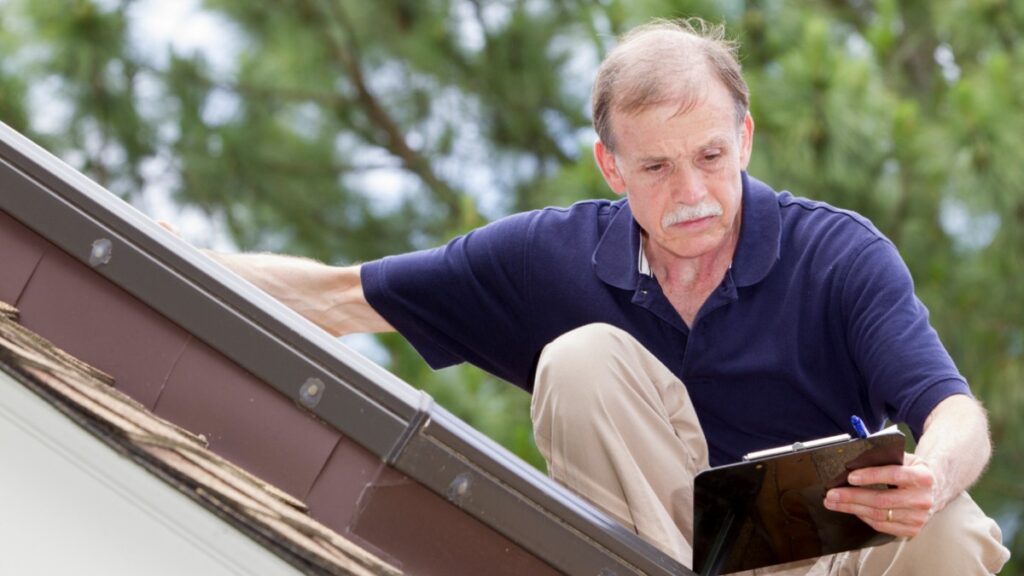

Finding a Public Adjuster for Roof Claim

Facing a roof insurance claim? A public adjuster helps secure a fair payout. Avoid denied or low offers—get expert assistance today!