Key Points:

- Public adjusters represent the policyholder’s best interests, while insurance adjusters work for the insurance company.

- Public adjusters tend to secure higher claim payouts by thoroughly reviewing policies and damages.

- Understanding when to hire each type of adjuster can directly impact your claim outcome.

Once disaster strikes, and you find yourself needing to file an insurance claim, the adjuster you work with can have a major influence on the outcome of your case. Understanding the difference between a public adjuster vs insurance adjuster can be crucial, and the results may have long-lasting financial implications.

The Main Difference Between A Public Adjuster And An Insurance Adjuster

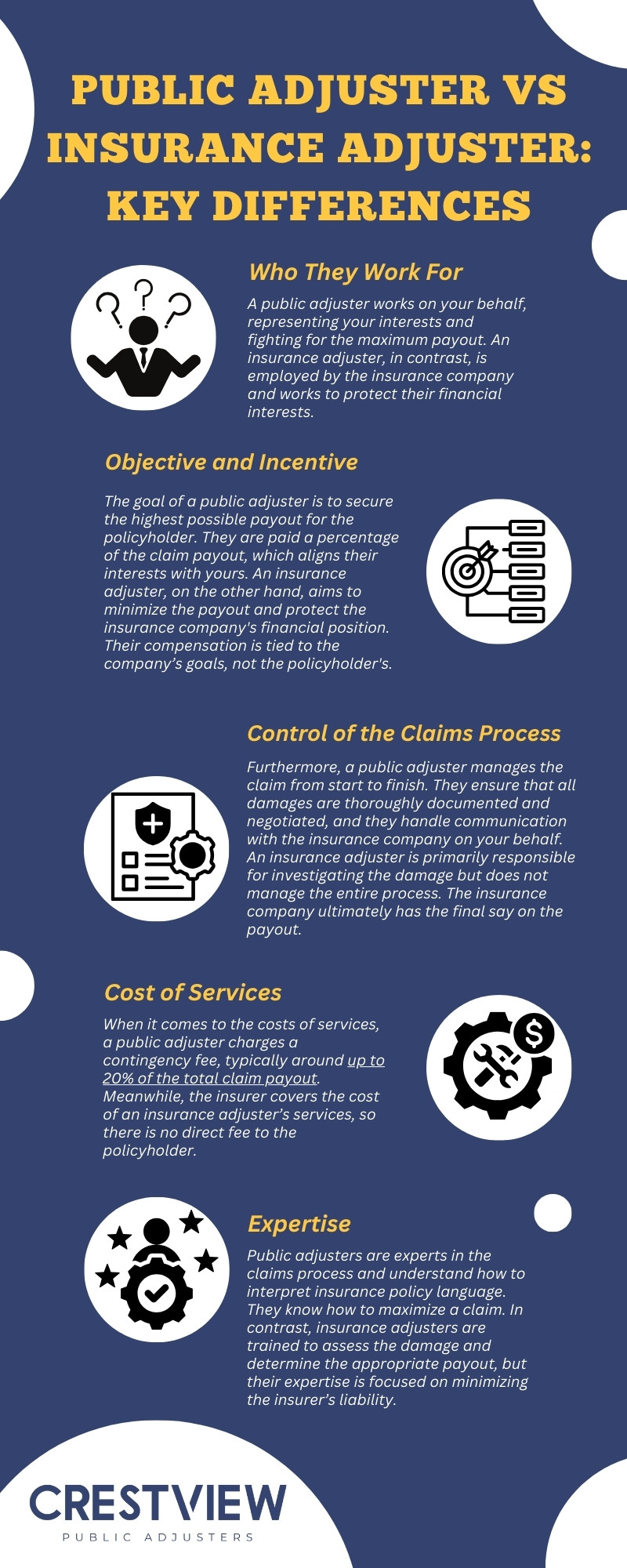

A public adjuster represents the policyholder, fighting for the highest settlement possible. In contrast, an insurance adjuster works for the insurance company, with their primary goal being to minimize payouts on claims.

What is an Insurance Adjuster?

An insurance adjuster is a professional employed by your insurance company to assess the damage or loss caused by a covered event. Their job is to evaluate the claim, determine its validity, and estimate the amount of compensation the insurer will provide based on the terms of the policy. In short, an insurance adjuster is hired to protect the insurance company’s financial interests, which may not always align with your goals.

Insurance adjusters typically conduct an on-site inspection of the damaged property, document evidence of the loss, and work with experts, such as contractors or engineers, to assess the full extent of the damage. They use this information to make a recommendation on how much the insurance company should pay. The adjuster then submits their findings to the company for approval, and the insurer may accept or dispute the assessment.

Though they are trained professionals, insurance adjusters are not working in your best interest. Their compensation is tied to the insurance company’s bottom line, meaning they are often incentivized to minimize the payout. This could result in lower compensation than what you may deserve, especially if you don’t have a strong understanding of the damages or policy language.

What is a Public Adjuster?

Unlike an insurance adjuster, a public adjuster is an independent expert hired by you, the policyholder. Their primary role is to represent your interests and ensure you receive the maximum possible settlement for your insurance claim. Public adjusters are paid on a contingency basis, meaning they typically take a percentage of the final settlement amount. This structure incentivizes them to work as hard as possible to secure a higher payout for you.

A public adjuster will take a comprehensive approach to managing your claim. From reviewing the insurance policy in-depth to documenting damages, negotiating with the insurance company, and fighting for a fair settlement, they handle every step of the process. Their goal is to secure a claim payout that fully reflects the loss, making sure that you’re compensated fairly for your damages.

Public adjusters are experts in the complexities of insurance policies, and they know how to leverage policy language to ensure you’re not shortchanged. By hiring a public adjuster, you’re ensuring that someone is working solely for your benefit, and their focus is on maximizing your settlement, not protecting the insurance company.

Key Differences Between A Public Adjuster vs Insurance Adjuster

Comparing a public adjuster vs insurance adjuster reveals several key differences. These distinctions not only affect how each adjuster operates but can also have a significant impact on the outcome of your insurance claim.

When Should You Hire a Public Adjuster?

While it’s not necessary to hire a public adjuster for every claim, there are specific situations where having one can make a significant difference. Here are some scenarios where hiring a public adjuster might be your best option:

1. Major Property Damage

A public adjuster can ensure that all of the damage to your home or business is documented and properly assessed. While insurance adjusters may overlook hidden or less obvious damages, a public adjuster will fight to ensure that they are all accounted for.

2. Disputes with the Insurance Company

If the insurance company has underpaid or denied your claim, a public adjuster can help navigate the appeals process. They can review the policy, gather evidence, and provide expert testimony to back up your claim.

3. Complex Claims

For complicated claims involving multiple damages or difficult-to-assess losses (e.g., business interruption claims or extensive damage to property), a public adjuster can bring in the necessary experts and resources to build a strong case for you.

Benefits of Hiring a Public Adjuster

Hiring a public adjuster provides several advantages that can be crucial to the success of your claim:

- Maximized Payout: Public adjusters are experts at identifying the full extent of damages and knowing how to leverage your policy’s terms for the highest possible payout.

- Less Stress: Filing an insurance claim can be laborious and stressful. A public adjuster deals with all the details, leaving you with one less thing to worry about.

- More Time to Focus on Recovery: With a public adjuster handling the claim, you can focus on your personal or business recovery instead of navigating the complex claims process.

- Expert Negotiation: Public adjusters have the experience to negotiate with the insurance company effectively, ensuring you get a fair settlement.

Get Professional Help with Your Claim in New York, New Jersey, and Florida

At Crestview, we understand the ins and outs of insurance claims and are committed to securing the highest payout for our clients. Whether you’re facing damage from a natural disaster, property damage, or business interruption, our public adjusters are here to help. Get in touch with us today to schedule your free consultation, and let us guide you through the claims process with professionalism and expertise.

Don’t let an insurance claim overwhelm you. Crestview’s public adjusters in New York, New Jersey, or Florida, are ready to maximize your payout and handle your claim from start to finish. Reach out today and get the support you need!