Key Points:

- Knowing the right questions to ask an insurance adjuster about water damage can ensure a fair settlement.

- Coverage depends on the source of the water damage, policy limits, and exclusions.

- Public adjusters can help policyholders maximize their claims and navigate insurer negotiations.

Dealing with water damage claims, it’s crucial to ask your insurance adjuster the right questions to protect your rights and maximize your settlement. Coverage, exclusions, and depreciation play a role in your final payout. Below are the most important questions to ask, along with explanations on why they matter.

Does My Insurance Cover This Type of Water Damage?

Not all water damage is treated equally under an insurance policy. Some types, like sudden pipe bursts, are covered, while others, like gradual leaks or flood damage, may not be.

Most homeowners’ policies cover sudden and accidental water damage but exclude flood damage, sewage backups, and gradual leaks. Ask your adjuster:

- What specific types of water damage does my policy cover?

- Are there any exclusions I should be aware of?

- Will my claim be denied if the damage is due to wear and tear?

Understanding these details can help you determine whether your claim will be fully or partially covered and prepare for potential disputes.

How Is the Damage Assessed and Valued?

Insurance companies use specific methods to determine the extent of damage and how much they will pay. If you don’t understand their process, you might accept a lower settlement than you deserve.

Adjusters may assess damages based on:

- Depreciation: Older items are valued lower due to wear and tear.

- Replacement Cost vs. Actual Cash Value (ACV): ACV factors in depreciation, while replacement cost covers the full expense of new materials.

- Pre-existing Conditions: Any damage before the reported incident might be excluded.

Ask your adjuster:

- Are you valuing my claim based on replacement cost or ACV?

- Will depreciation be applied, and if so, how?

- Can I see a detailed breakdown of how you calculated my settlement?

Questioning their valuation, you ensure that your settlement accurately reflects your losses.

Will My Policy Cover Additional Living Expenses (ALE)?

If your home is uninhabitable due to water damage, you may need to stay elsewhere while repairs are made. Some policies include Additional Living Expenses (ALE) coverage, which reimburses temporary housing, meals, and transportation.

Ask your adjuster:

- What expenses are covered under ALE?

- Is there a time or cost limit on my ALE coverage?

- Do I need to provide receipts for reimbursement?

Ensuring you have ALE coverage prevents financial strain if you need to relocate during repairs.

What Documentation Do You Need for My Claim?

Proper documentation can make or break your water damage claim. Insurers often require evidence to justify the claim amount. Missing information can delay or reduce your payout.

Essential documents include:

- Photos and videos of the damage before and after mitigation efforts.

- Receipts and invoices for repairs and temporary housing.

- A written statement detailing the incident.

Ask your adjuster:

- What specific documents do you need to process my claim?

- Can I submit additional estimates from my own contractor?

- How long do I have to submit supporting documents?

Submitting thorough and timely documentation helps speed up the claims process and minimizes disputes.

How Long Will It Take to Process My Claim?

Claim timelines can vary depending on the extent of damage, policy details, and the adjuster’s workload. Knowing the expected timeline can help you plan and hold the insurer accountable.

Most insurance companies have a 30-day deadline to respond to claims, but some states enforce different regulations. Ask:

- What is the typical processing time for a water damage claim?

- Are there any factors that could delay my claim?

- How will I be updated on my claim status?

If the adjuster gives vague answers, request a written timeline to track progress.

Do I Need to Hire a Public Adjuster?

Many policyholders don’t realize they can hire a public adjuster to advocate for their best interests rather than relying solely on the insurance company’s adjuster. Public adjusters:

- Independently assess water damage and policy coverage.

- Negotiate for higher settlements.

- Handle claim disputes if the insurer offers an unfair payout.

Ask your adjuster:

- Can I get a second opinion on the damage assessment?

- Am I allowed to have a public adjuster represent me?

- If I disagree with the settlement offer, what are my options?

If your claim is undervalued or denied, a public adjuster can help level the playing field.

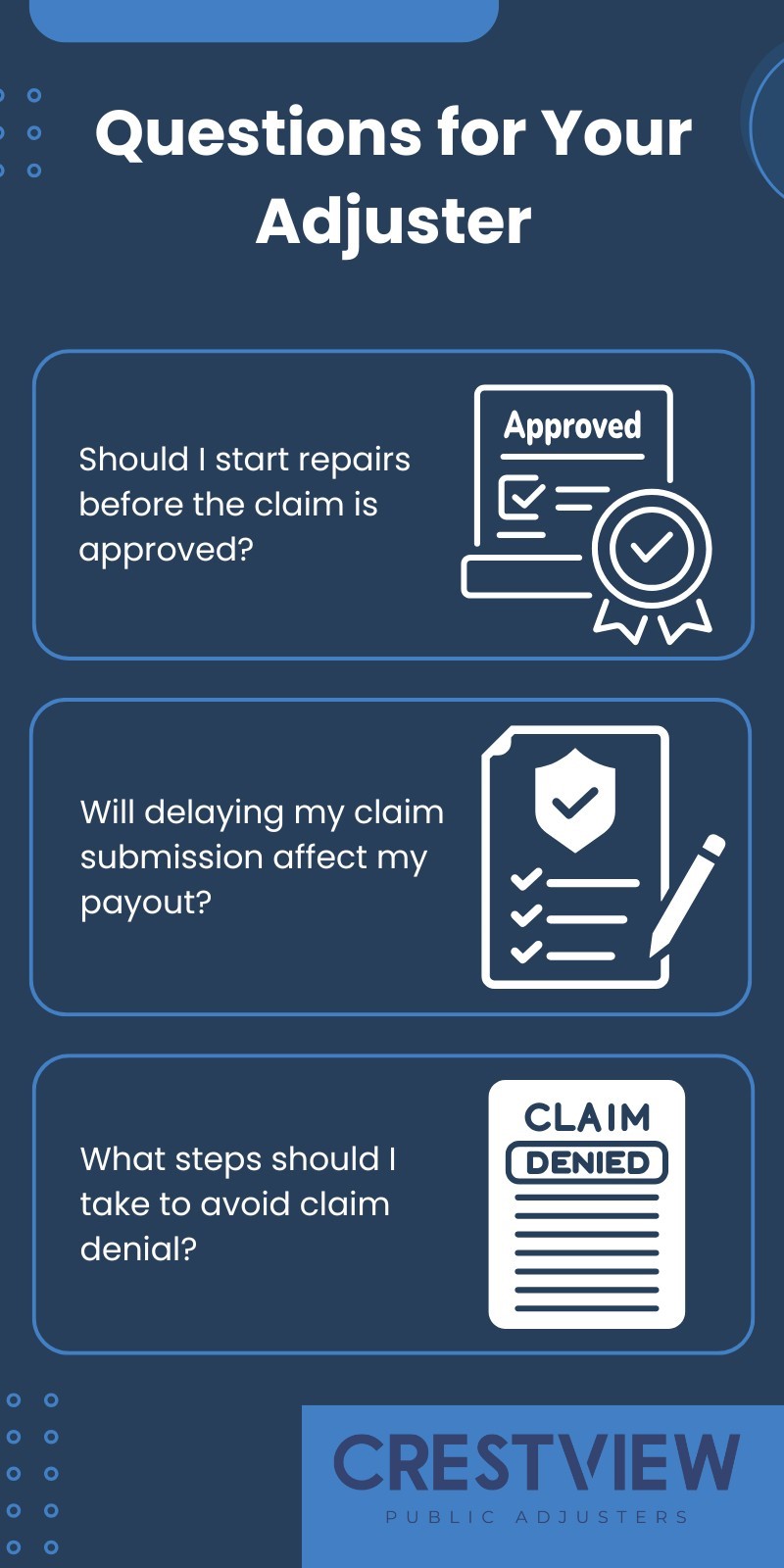

What Should I Avoid Doing to Prevent Claim Denial?

Certain mistakes can result in claim rejection or reduced payouts. Many policyholders unknowingly jeopardize their claims by failing to follow proper procedures.

Avoid making permanent repairs before the adjuster inspects the damage, as this can lead to claim disputes.

Get the Compensation You Deserve with a Public Adjuster

Dealing with water damage claims can be frustrating, especially when insurance companies minimize payouts. A public adjuster ensures you receive fair compensation and handles claim negotiations on your behalf.

At Crestview Public Adjusters, we specialize in water damage claims across Florida, New Jersey, and New York. Whether your claim is underpaid or denied, our team fights for the maximum settlement you’re entitled to.

Don’t settle for less—let us handle your claim. Contact Crestview Public Adjusters today!